A new transmission grid reliability report raises concern about increasing risk of not being able to meet transmission system load with available electric power generation. The answer? Prioritize flexible resources like hydropower and pumped storage.

The entity charged by the Federal Energy Regulatory Commission, FERC, with ensuring electric power reliability at regional levels is raising some alarm bells about the changing resource mix. NERC’s (North American Electricity Reliability Corp.) long-term reliability assessment is designed to give the electricity industry a sense of trends that are developing that could impact reliability on the grid.

The latest report finds that nearly all areas of the United States will face an increased risk of loss of load, which occurs when system load exceeds available generation. This includes California, which could see up to 22 hours of load-loss in 2022. After this summer’s blackouts, that news is sobering.

Why It Matters

NERC’s analysis demonstrates the growing need for flexible resources — like peaking hydro and pumped storage — to balance a decarbonized grid. Hydropower and pumped storage are tailor-made for the clean energy transition. Both resources can provide essential reliability and flexibility on the system.

“It’s very important that FERC and the regional transmission organizations (RTOs) listen to NERC’s warning and begin discussions on how to better compensate flexible resources that keep the lights on while enabling the clean energy transition,” said Alan Michaels, chair of the National Hydropower Association’s Markets committee

Deep Dive

Generally, these assessments are wonky dives into electricity reliability issues … the kind of report that electrical engineers love and other stakeholders ignore. This year’s report, however, is worth reading. It’s a sobering look at the challenges the grid will face in the coming decade. The report warns that wind and solar resources are “fundamentally changing how our bulk power system is planned and operated.”

Part of the challenge, NERC argues, is that the current system is designed around a dispatchable fleet that has a high degree of operational certainty. As wind and solar begin to dominate the grid, our traditional approaches to ensuring reliability, like reserve margins and capacity estimates, “may give a false sense of comfort” to grid planners.

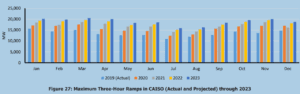

Another increasing challenge is the ability to meet steep ramps caused by large penetration of solar resources. The net peak demand (essentially, the peak demand minus wind and solar resources) has become a difficult period in California, especially as the operator must dispatch other resources like hydro and natural gas quickly to make up the evening peak which occurs as solar tapers off.

Figure 27 from the NERC Report shows the dramatic increase in projected maximum three-hour ramps in California. Hydropower and pumped storage (both in-state and imports from the Northwest) provide a significant share of the net peak ramp in the evening hours.

What does NERC recommend?

First, planning needs to be reformed. Utilities ensure reliability by estimating their peak demand (usually, for the hottest day of the year) and adding a reserve margin, or cushion, that accounts for demand forecasting errors, generation outages and operating reserves. As more of our electricity comes from energy-limited resources like wind and solar, operators are forced to manage the grid with greater uncertainties.

For example, solar and wind resources are de-rated when it comes to how much peak capacity they can be expected to contribute. However, these de-ratings may not accurately reflect the conditions in real time. Forecasting errors can mean that wind and solar production can be less than anticipated. This can be compounded by demand forecasts that may underestimate usage from areas that have high penetration of behind-the-meter solar.

Second, NERC urges regulators and policymakers to “develop policies that prioritize reliability, such as promoting flexible resources.” Essentially, NERC is saying that operators will need more flexible resources as they match uncertain load with uncertain generation. California’s August 2020 blackouts are a great example of the essential role flexible hydro can play. There, the blackouts occurred not during the system peak, but two hours later when solar was dropping faster than demand.

CAISO’s analysis of the event found that hydro peaked at the exact time of greatest system stress and provided essential energy and operating reserves. In fact, hydropower resources performed better than their resource adequacy obligations. While conventional hydro and pumped storage hydro resources provide roughly 14% of in-state generation, they can supply as much as 25% of the total regulation requirements and 60% of the total spinning reserves.

Without the flexibility of hydro, the California blackouts surely would have been much worse.

What’s Next

When it comes to moving the needle on market design changes, NERC outlooks don’t really cut it. However, this year’s assessment should provide state and regional policymakers some urgency for ensuring reliability while we undergo this unprecedented shift in how we generate and use electricity. In fact, some RTOs have already begun to identify and compensate their flexibility needs, in part due to prodding from NERC and FERC.

New market mechanisms are taking shape. For example, the California Independent System Operator, CAISO, recently reached agreement with NHA members Seattle City Light and Chelan County Public Utility District to compensate their hydro resources for inertial and primary frequency response — services that are not compensated in most organized markets.

It’s still early days, but agreements like these are promising and can serve to set examples in other regional markets throughout the U.S.