Understanding the Regional Transmission Operator (RTO) process is critical for hydropower owners and operators, as advocating for market rule changes can determine anything from faster interconnection processes to the value of a sold product such as capacity or ancillary services. Yet, in order for these rules to better incorporate hydropower’s value proposition, organizations must take part in stakeholder meetings.

The Federal Energy Regulatory Commission (FERC) plays a critical role in the stakeholder process, as FERC’s authority over wholesale markets are derived from Sections 205 and 206 of the Federal Power Act, which requires that all rates, terms & conditions, and rules & regulations that impact those rates, terms, and conditions be filed with FERC in order to be deemed “just and reasonable.” This process is captured in the Tariffs, which governs the rules on how RTOs and market participants operate.

For hydropower owners and operators selling power, being at the table for stakeholder activities is crucial, as it allows for greater say and contribution when it comes to shaping the rules and regulations dictating the sale of hydropower.

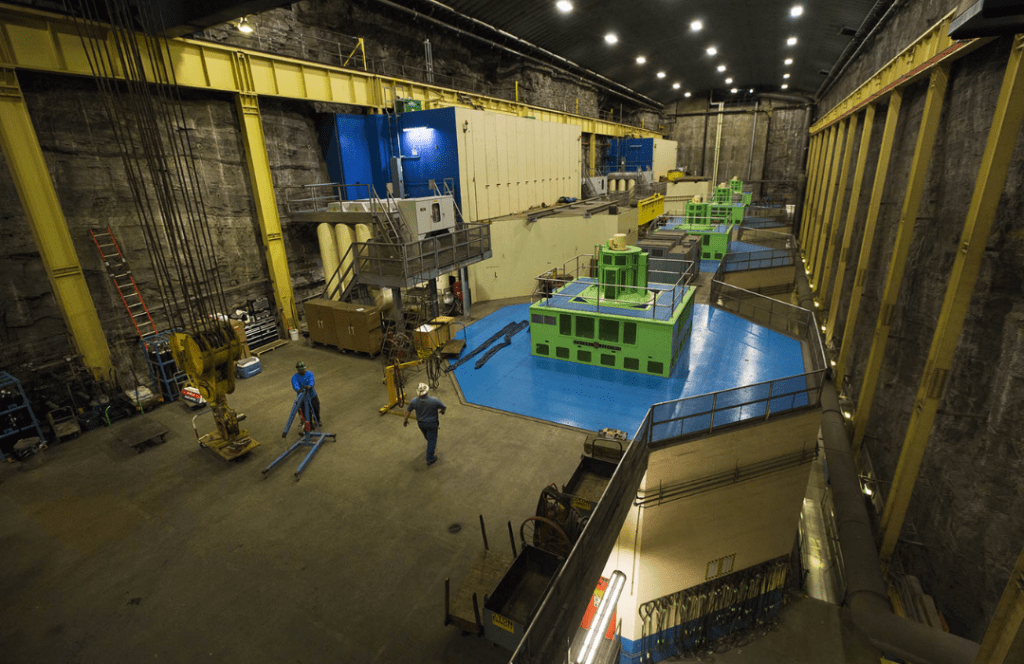

Inside FirstLight Power’s Northfield Mountain pumped storage hydropower station, located in Massachusetts.

BACKGROUND INFORMATION

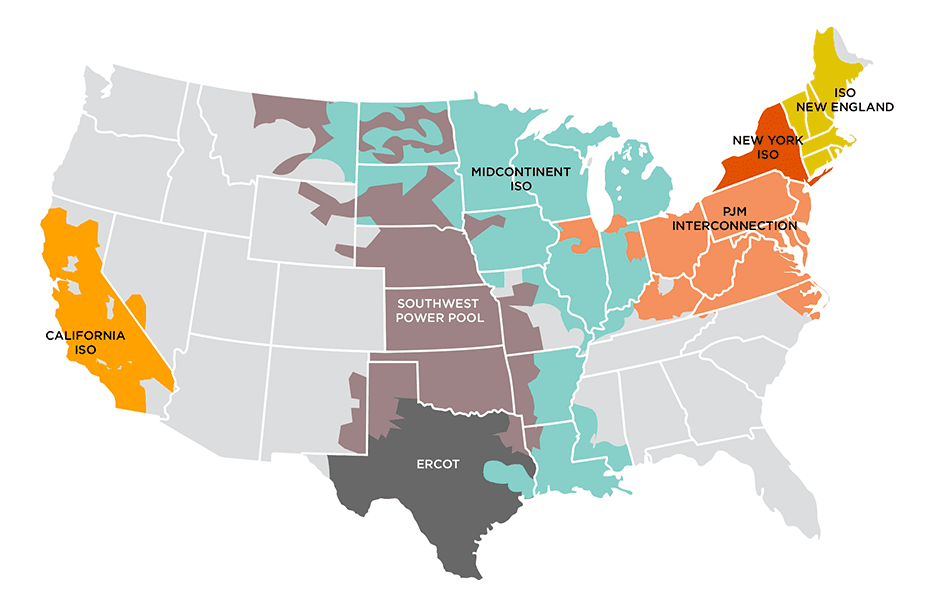

Currently, there are seven RTOs or ISOs in the United States: PJM Interconnection (“PJM”), New York Independent System Operator (“NYISO”), ISO-New England (“ISO-NE”), Midcontinent ISO (“MISO”), Southwest Power Pool (“SPP”), Electric Reliability Council of Texas (“ERCOT”), and California ISO (“CAISO”).

Every RTO in the United States has a Tariff that governs the rules on how market participants operate in those markets. The Tariff also governs how the RTO operates from transmission planning to how the interconnection queue is handled, as well as market rules for suppliers and load interests.

Changes to the Tariffs are considered within those stakeholder bodies, which all have varying governance processes, and are then filed to FERC under Section 205 of the Federal Power Act. Each stakeholder body also has varying governance processes. FERC then decides if those market rules are just and reasonable.

Therefore, if you’re a market participant, and you’d like to see rule changes (e.g., faster interconnection processes, rules that create more or less value for the product you sell, etc.) it is incumbent upon your company to become an active participant in stakeholder meetings.

Map of the RTOs/ISOs in the United States.

UNDERSTANDING FERC ORDER 719

To understand the current implications of Order 719, it’s important to know about FERC Order 2000, which created the minimum requirements for RTOs, but it did not mandate a specific type of governance process.

In 2008, FERC revisited the issue with FERC Order 2000 by creating Order 719; yet, FERC declined to mandate a specific governance process and instead created four governing principles:

- Inclusiveness to ensure all views brought before the different boards of RTOs.

- Fairness in balancing diverse interests that ensure that competing interests are heard and that one sector does not dominate the proceedings.

- Representation of minority positions to ensure such positions are considered. Although FERC does not require supermajority voting, the process must ensure consideration of the interests of minority parties.

- Ongoing responsiveness to customer and stakeholder needs to ensure that the stakeholder process is continually evaluated for improvement.

Managing these four principles can create a messy and sometimes frustrating process. However, RTOs value stakeholder input as they balance disparate interests and incorporate numerous tradeoffs to ensure a reliable grid and a just and reasonable set of rules.

THE IMPORTANCE OF GOVERNANCE

Each stakeholder body has different processes depending on their governance. For example, PJM’s stakeholder process is shared between the stakeholders and the PJM Board of Governors. Unless the Board acts otherwise, stakeholders must agree on a proposal to file to FERC.

Other stakeholder bodies, such as NEPOOL, perform an advisory role to the RTO – in this case, ISO-NE. ISO-NE has the Section 205 filing rights and therefore does not need approval by NEPOOL.

CAISO represents another example, as CAISO’s model does not have a formal stakeholder body per se, but there is a notice and comment process amongst stakeholders. The CAISO Board has the ultimate authority on what is filed to FERC.

Finally, participation in each process is slightly different. For instance, NEPOOL is not open to non-market participants unless invited as a guest. PJM and CAISO allow for non-market participants to participate, but in the case of PJM, voting occurs amongst the members (i.e., market participants), whereas in CAISO anyone can submit comments. To make the point clear, NHA could not participate in NEPOOL and could not vote in PJM, for example.

PJM President and CEO Manu Asthana introduces the results of the 2019 Stakeholder Satisfaction Survey at the meeting of the Members Committee.

WHY SECTION 205 MATTERS

FERC’s authority over wholesale markets are derived from Sections 205 and 206 of the Federal Power Act. The Federal Power Act requires that all rates, terms and conditions, and rules and regulations that impact those rates must be filed with FERC to be deemed “just and reasonable,” which is captured in the Tariffs, as it governs the rules on how market participants operate.

To amend the Tariffs, an RTO or utility can file changes under Section 205. FERC’s role in this case is reactive in nature, and FERC needs to either rule that the change is just and reasonable or pass the determination that it isn’t.

Alternatively, an organization could file a complaint under Section 206, which is a higher legal standard than Section 205. In this case, the complainant has the burden to demonstrate that the existing Tariff, or section of it, is “unjust and unreasonable.” FERC then sets what is called a replacement rate, term or condition, that is “just and reasonable.”

The stakeholder process is where amendments to the Tariff are considered. If adopted, the change is then filed under Section 205, which states that FERC has 60 days to rule whether or not the change is “just and reasonable.” Due to Section 206 being the higher legal standard, it is most beneficial for market participants to get amendments or market rule changes to be filed under Section 205.

It’s also important to consider the element of time. FERC must respond in 60 days under Section 205, yet FERC is under no obligation to respond to a complaint under Section 206. Again, it is imperative for RTOs to hear market participants’ input so that company positions are captured in a Section 205 filing.

HOW TO GET INVOLVED

Since each stakeholder body has different governance, yet an outsized role in the shaping of market rules, NHA adjusted the Markets Committee to be a clearinghouse of items of interest to hydropower organizations working their way through the stakeholder process.

NHA’s goal is to share information while being additive to hydropower interests wherever possible. If members desire, NHA can file comments or protests in proceedings (either Section 205 or 206) on issues that materially impact the interests of hydropower owners in those RTOs.

For more information reach out to Michael Purdie, Director of Regulatory Affairs and Markets, at michael@hydro.org.

Additionally, if you’re interested in learning more, identify the stakeholder rules pertaining to the RTOs your organization participates in and take the necessary steps to become more involved.