When states began to de-regulate their electricity industry 25 years ago, they had one major goal: to introduce competition into power generation. The creation of regional transmission organizations (RTOs) made it easier to economically dispatch generators based on price.

Even competitive market skeptics will agree this experiment was hugely successful — saving consumers billions of dollars.

But what if price and reliability are not your only goals?

What if states, upset that the markets are not incenting enough new, clean resources, begin to subsidize preferred technologies like wind, solar and nuclear?

What if these price signals are not also sending the right retirement signals for resources we won’t need in the future?

And most importantly for hydropower and pumped storage, are capacity markets providing adequate compensation for the value these resources provide day in and day out?

All these questions are being asked and issues are clashing in a big way at RTOs, state public utility commissions (PUCs) and the Federal Energy Regulatory Commission (FERC). The tension between states that want clean energy and FERC that is trying to protect competitive markets is at a fever pitch.

Capacity markets and MOPRs (Minimum Offer Price Rules)

Capacity markets were introduced two decades ago to solve a few specific issues. One, states who gave up their authority to direct utilities to build new plants or shut down old ones needed a guarantee that this new marketplace would send adequate price signals to maintain reliability. Two, there was a missing money problem. Economists were skeptical that energy revenues alone would provide enough money to maintain the resources we needed for reliability. They needed another payment stream to ensure they would stick around. And three, their needed to be a locationally specific price signal to tell developers to build new plants where the value would be greatest.

Consequently, capacity markets were developed in New England, Pennsylvania, New Jersey, Maryland, and New York — ISO-NE, PJM and NYISO. (Other RTOs or ISOs have bilateral constructs.) In these capacity markets, all generators must bid into an auction run by the RTO at a price they are willing to “be available” when the grid might need them three years forward. If you clear the auction, it means you are now committed to providing the RTO with energy three years in the future during a scarcity event. If they don’t show up when called upon, the generators can be subject to penalties.

A couple years ago, FERC was concerned that generators who were getting state payments (either in the form of RECs, ZECs or other mandated contracts) were offering into the capacity market at an uncompetitive level and thus reducing the price for everyone.

Enter the MOPR, or minimum offer price rule. The MOPR was meant to set a floor on prices that subsidized resources could bid into the auction. It applied to almost any new resource that received some kind of state benefit. FERC’s concern of price suppression was quickly overwhelmed by the opposition to this rule from the states, Congress and the clean energy industry.

However, FERC Chairman Richard Glick is now in the process of directing RTOs to remove the MOPR.

On July 15, 2021, FERC announced an Advance Notice of Proposed Rulemaking in which the Commission seeks comment on, pursuant to section 206 of the Federal Power Act, the potential need for reforms or revisions to existing regulations to improve the electric regional transmission planning and cost allocation and generator interconnection processes.

Zombie Generators

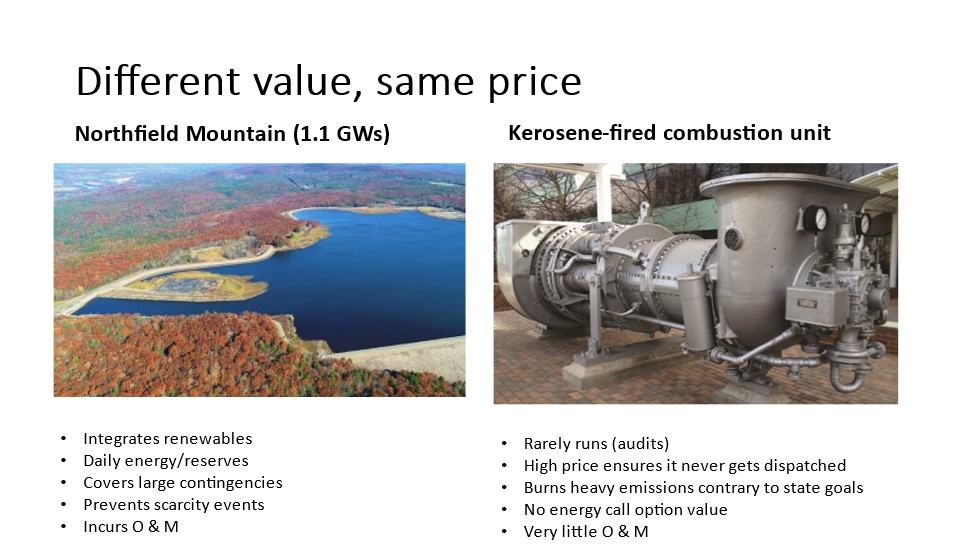

The concern with price signals is still real. A good example is of so called “zombie generators” in ISO-NE. Zombie generators are generators that clear in the capacity auction, but almost never run in the energy market. These generators are almost exclusively oil- or kerosene-fired units that are old, dirty, and expensive. They provide little value to the system. They also have little operations and maintenance costs because they rarely run and when they do run (usually for testing) they burn fossil fuel — contrary to state policies.

On the other hand, you have the region’s two largest storage facilities (Northfield Mountain and Bear Swamp). These large pumped storage units support the system daily by providing critical flexibility. They also allow the ISO to recover from contingency events like a large generator tripping or a transmission line outage. They provide other services like voltage control, regulation, and inertia.

Why It Matters

Northfield Mountain and Bear Swamp will be vital to integrating renewables in the future. And yet, they receive the same capacity price as the oil-fired combustion unit that never runs. While the oil unit can survive on capacity market payments alone (because of little O&M costs), the two pumped-storage hydro facilities have significant safety and O&M investments to keep them running.

One price; two very different values to the system.

Capacity markets need to evolve to ensure that the resources we need (like existing hydropower and pumped storage) are not being sent the same price signal as the resource we can likely do without.