To ensure reliability of electricity delivery, independent system operators (ISOs) and regional transmission organizations (RTOs) often call upon hydropower and pumped storage to provide flexibility outside of standard market products. While there is a process – known as “uplift” – that compensates these projects for such services, that same process is often restricting those assets from operating at their optimal capability and is not necessarily recognizing their true value to the grid.

If these resources are continually relied on to ensure reliability, isn’t time for grid operators to start thinking about creating a product that values this service?

Electricity Dispatch Protocol

Competitive regional wholesale electricity markets in the U.S. took shape over two decades ago. Their premise was simple: dispatch electricity across wider footprints to enhance competition and lower costs. To do this, the Federal Energy Regulatory Commission (FERC) created independent system operators (or ISOs and RTOs), who act like air traffic controllers for the grid.

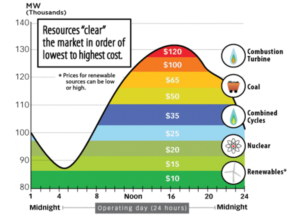

Every day, RTOs forecast supply and demand and then dispatch generators from least costly to most costly. And because most electricity cannot be stored, RTOs must ensure that supply and demand are balanced every five minutes.

This process has been incredibly successful, saving consumers billions of dollars while maintaining reliability.

So What’s the Problem?

There are inevitably times when the RTOs — to ensure the lights stay on — take an action that upsets this least-cost dispatch order. These actions, known as “out-of-market” actions, can involve a variety of scenarios, such as dispatching a more expensive unit, directing a generator to either generate more or less than it wanted to, or keeping a unit from generating to ensure there is enough backup energy.

In many of these situations, RTOs call upon hydro and pumped storage projects, because of their flexibility attributes. In essence, hydro and pumped storages projects are disproportionally relied on to provide services that are “out of market.”

Therein lies the challenge. Instead of being allowed to compete on a level playing field in a least cost dispatch situation, these projects are being required to provide services, take actions, and/or operate in ways that may not be the most optimal.

While the grid operators pay for these services, through an “uplift” payment, that payment isn’t necessarily reflective of the real value the project provides to the system.

The Deep Dive

Dispatching generators based on cost is a straightforward concept (generators bid in their electricity supply and the RTO stacks them, starting with the cheapest generator (typically nuclear units that must run or wind, solar and hydro that have zero fuel costs). This process ends with the last unit that is needed to meet demand. That unit is the “marginal” unit and it sets the price for every other unit.

However, this process quickly becomes complicated when you factor in the limits of the transmission system (how much the lines can handle), the various operating characteristics of generators (how and when they can start and stop), and various reliability requirements.

While least-cost dispatching works in most scenarios, there are inevitably times when the RTO must call an audible for reliability reasons. Essentially, they must take some action that upsets the least-cost dispatch order and adds costs to ensure the lights stay on.

These “out-of-market” actions could include dispatching a more expensive unit, directing a generator to either generate more or less than it wanted to, or keeping a unit from generating to ensure there is enough backup energy. There are numerous scenarios where this can occur.

The RTOs try to “make whole” the generator that was dispatched out of cost merit with what are called uplift payments. Uplift payments are provided to generators to allow them to recover the costs of the additional action the operator required them to take.

The problem is that out-of-market actions are not reflected in market prices. They do not give generators an opportunity to compete to provide the service. More importantly, uplift lacks transparency and can mask the true system conditions like energy or reserve scarcity. In general, RTOs seek to minimize uplift payments because the uplift costs are socialized to everyone in the market.

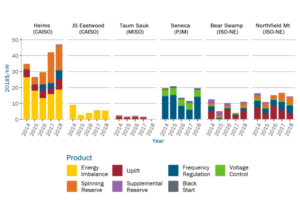

The Federal Energy Regulatory Commission (FERC) agrees that uplift is generally a bad thing and recently began tackling the issue by first requiring the RTOs to publish lots of data about uplift. The data shows that hydro and pumped storage are receiving a disproportionate share of uplift payments. For example, in several markets, pumped storage hydro can be a disproportionate recipient of uplift payments due to its inherent flexibility. As shown in the chart below, hydro units in ISO-NE regularly earn 50% or more of their total annual ancillary service revenues from uplift.

While uplift payments represent a small portion (around 1% to3%) of total system costs, these payments can still total in the tens of millions of dollars and disproportionately go to flexible resources like hydropower and pumped storage. For example, in 2019 ISO-NE reported that pumped storage was the only recipient of “posturing credits.” Posturing is when the ISO directs a generator to be held back to ensure sufficient reserves on the system — even when it would be more profitable for them to generate.

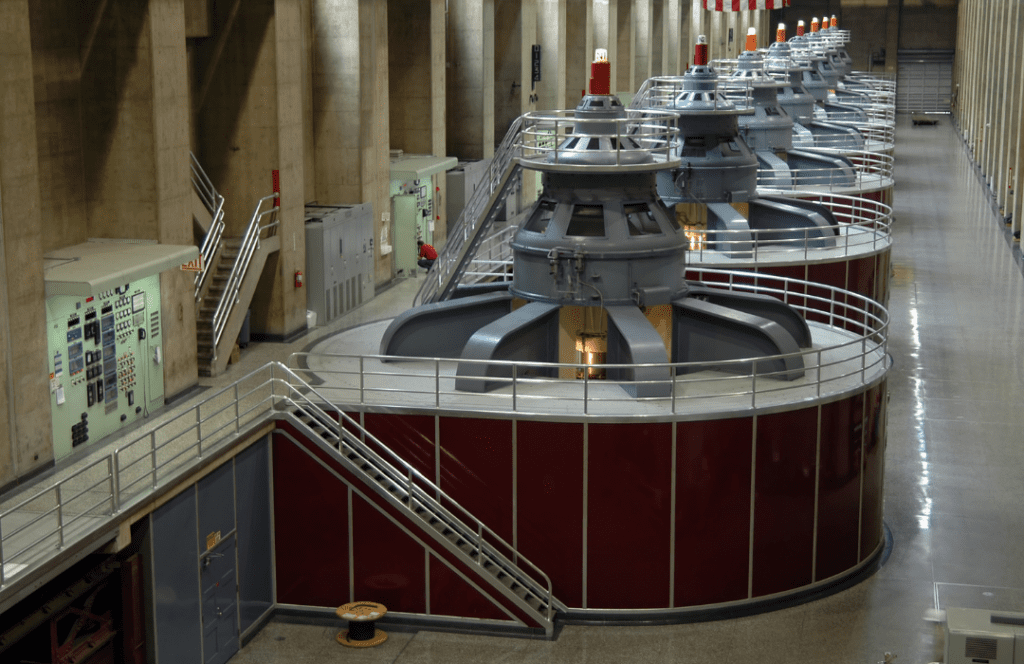

Bottom line: Grid operators tend to rely heavily on hydropower given its low-cost, flexible characteristics and reliability. According to EIA, hydropower has the fastest start–up times on the grid with most hydro turbines able to go from cold start to full operations in less than ten minutes (some even quicker). By continuing to rely on them for out–of–market actions, the RTO is masking the true value that hydro and pumped storage provide.

What’s Next — What Can Grid Operators Do To ‘Un-Mask’ the True Value of Hydro and Pumped Storage?

Not every out–of–market action can be eliminated. However, if some resources are continually relied on to ensure reliability, then the grid operator should start thinking about creating a product that values the service.

Economists believe that uplift should be reduced and, to the extent practical, markets should provide technology-neutral products that reflect system conditions rather than singling out specific generators and asking them to do things out of market. After all that’s what competitive markets are all about.