After the U.S. House of Representatives passed the Build Back Better bill on Friday, November 19, the legislation now moves to the Senate. Included in the bill is a suite of incentives for the domestic manufacturing of “strategic clean energy components.”

This includes waterpower.

Specifically, the incentives include investment tax credits for advanced energy manufacturing capacity, in combination with targeted domestic supply chain production tax credits.

The suite of incentives represents a historic investment in American manufacturing, which is in line with President Joe Biden’s promise of revitalizing manufacturing and ensuring that the United States is globally competitive in the production of 21st century technologies.

The Deep Dive: Bill Calls for Revising, Expanding Section 48C of the Tax Code

The House Ways and Means Committee summary specifically spells out incentives for advanced energy projects, including the provision of a base credit and bonus credit for projects that create jobs and reduce carbon emissions.

In particular, the bill revises and expands Section 48C of the Tax Code. This section of the tax code currently provides investment tax credits (ITCs) for projects that equip or expand manufacturing facilities that produce specified renewable energy equipment, including wind, solar and geothermal property, fuel cells, microgrids, and carbon capture and sequestration property. In the expansion, “water” is specifically included as a “renewable resource” under section 48C for purposes of “qualifying advanced energy projects.” Therefore, water is now explicitly part of this list.

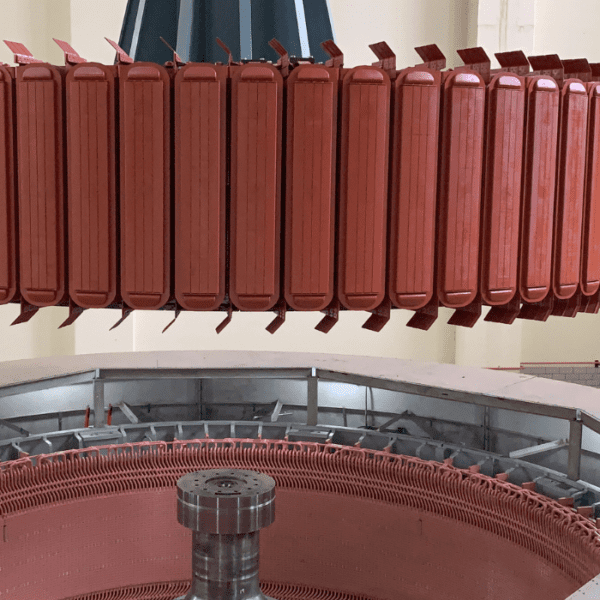

As part of the revision and expansion, the bill adds new eligible facilities that manufacture energy storage systems and components, electric grid modernization equipment or components, electric vehicles or bicycles and recharging or refueling equipment, property used to produce clean hydrogen, battery or energy storage recycling property, and equipment which re-equips a manufacturing facility with equipment designed to reduce greenhouse emissions by at least 20%. Many components used in hydropower plants would be manufactured at such facilities.

The tax credit for these new eligible facilities will be 30% — as long as prevailing wage and apprenticeship requirements are met. If such requirements are not met, the credit rate is 6%.

And, the bill includes direct pay as an option, in which the eligible facility can choose to receive direct payments from the federal government instead of the tax credits.

For calendar years 2022 and 2023, $8 billion in credits would be allocated. For calendar years 2024 through 2031, $1.875 billion would be allocated. Portions of the allocations would be reserved for projects in communities that have experienced substantial losses in automotive manufacturing ($800 million for 2022 and 2023 and $300 million thereafter). These same amounts are reserved for projects in “energy communities” (i.e., historically oil, gas and coal communities). The eligible facilities must be placed in service within four years of receiving an allocation.

Tax credits received under Section 48C would be “exclusive” – meaning the credit would not available for any investment if a credit is allowed under the Tax Code’s sections 48, 48A, 48B, 48F, 45Q or 45X.

Why It Matters

The new tax credits for U.S. facilities that manufacture clean energy technologies are essential to meet the goals of growing domestic clean energy manufacturing, bolstering domestic supply chains, creating jobs in the clean technology manufacturing sector, and increasing American clean energy exports.

For the U.S. hydropower industry, these credits will help maintain existing manufacturing facilities across the country, expand additional domestic facilities, and create good-paying jobs.

In total, the historic investments outlined in the Build Back Better legislation will help ensure the deployment of clean energy at the scale necessary to address the climate crisis.