In August 2022, President Biden signed the Inflation Reduction Act (IRA). Broadly, the IRA provides tax credits for new generation, including pumped storage, incremental conventional hydropower, and marine and hydrokinetic technologies.

While the tax credits pertain to new generation, determining how existing hydropower can benefit from the IRA without adding new generation is another matter, and this is where the 80/20 Rule comes into play. The 80/20 Rule includes existing assets owned by public power that could benefit from the new Elective Pay provisions in the IRA.

The 80/20 Rule is an administrative mechanism by which taxpayers with existing facilities can utilize tax credits designed for new facilities.

To better contextualize the benefits for hydropower, NHA is requesting clarification from the Treasury Department and Internal Revenue Service on important questions pertaining to how existing hydropower can apply the 80/20 Rule to operations, saving millions of dollars in capital expenses.

Additionally, by gaining greater clarification on the IRA’s Tech Neutral Credits, NHA is confident that outcome would be extremely beneficial to the existing hydropower fleet and for investments in new megawatts.

HOW DOES THE 80/20 RULE WORK?

To understand the 80/20 Rule in action, consider the following scenario:

A taxpayer must replace existing equipment. If the fair market value of the new equipment is 80% or more than the equipment left over, then the taxpayer can claim the tax credits as new. The wind industry has utilized this tax treatment for three decades to its benefit.

An example:

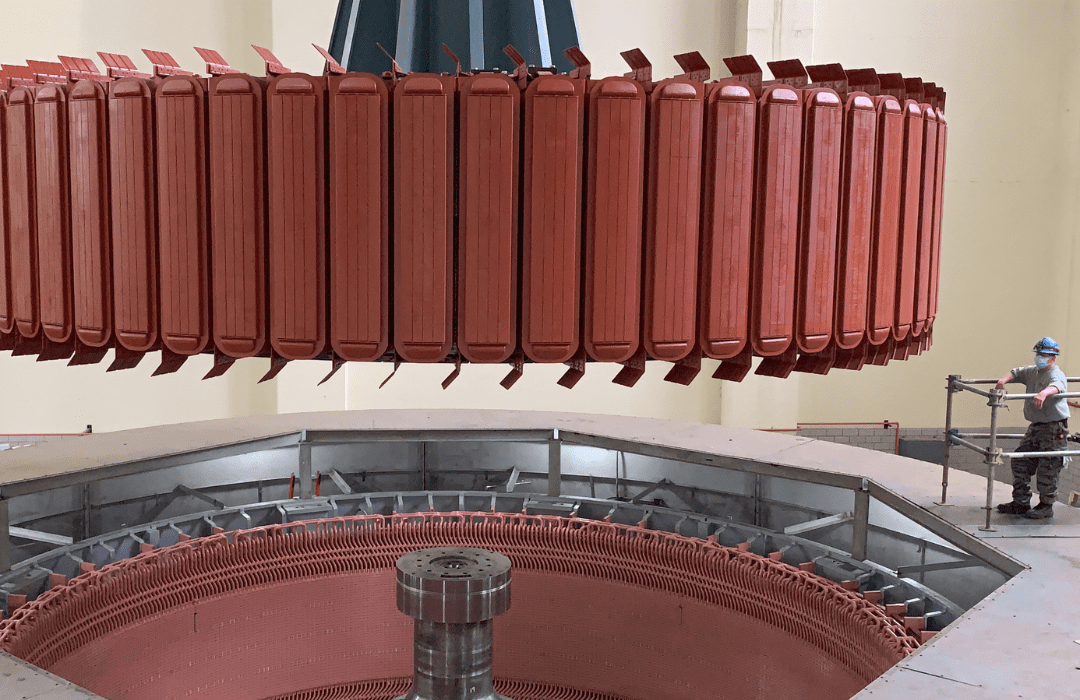

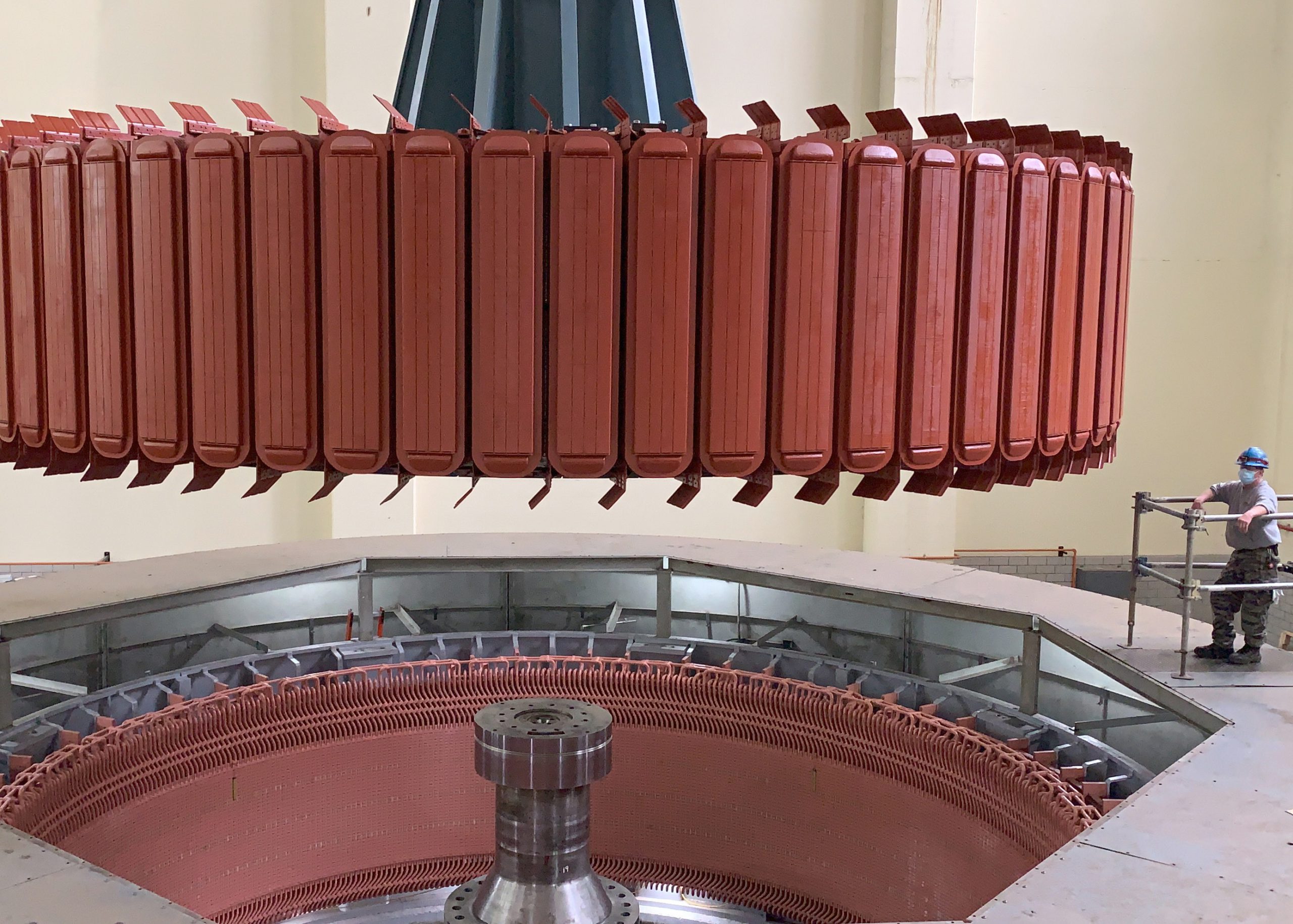

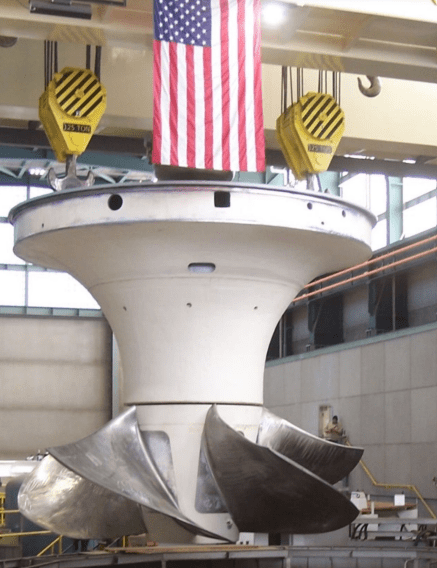

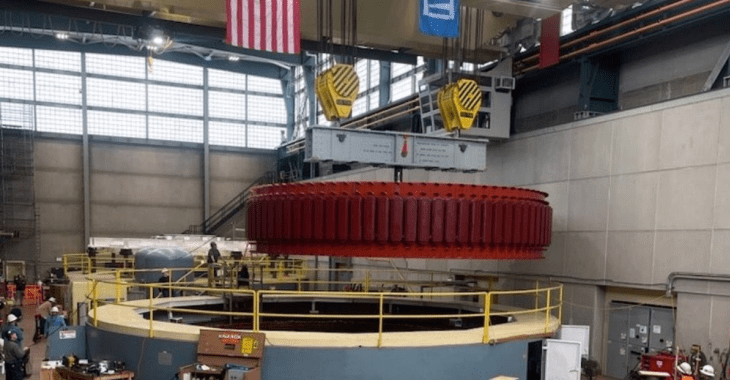

An asset owner is looking to replace a turbine and rewind a generator to extend the life of the equipment for generations without increasing its capacity or production while also acknowledging that the new equipment will likely be more efficient. The cost of the replaced and refurbished equipment is $18 million; however, some existing equipment (valued at $2 million) will not be replaced.

In the scenario above, 10% of the fair market value of the equipment is existing ($2 million/$20 million), so the asset owner passes the 80/20 test. Therefore, the asset owner can claim the Production Tax Credit (PTC) for ten years of production at the facility, or the asset owner can claim the Investment Tax Credit (ITC) against the taxable basis of the investment.

In the case of an Elective Pay eligible asset owner, these credits would be sent as a rebate back to the asset owner.

CAN HYDROPOWER BENEFIT?

Technically, existing hydropower can benefit from the 80/20 Rule. However, there is no guidance available to answer some obvious and important questions.

1. What property is included in the calculation (e.g., the whole facility, or just the turbine/generator/other equipment integral to the generation of electricity)?

For example, if a project owner spends $18 million to replace a turbine and rewind a generator, and the fair market value of that equipment, plus any reused equipment, is $20 million, then the existing equipment is $2 million. In this scenario, the owner has passed the 80/20 test ($2 million/$20 million = 10%).

However, if the dam, other civil works, and environmental enhancements are included in the calculation, and those assets are valued at $20 million, then the asset owner could not benefit from the 80/20 Rule ($22 million/$40 million = 55%).

2. Can I perform the calculation at the unit or facility level?

Using the above example, assuming a scenario involving a multi-unit facility within a powerhouse, one would have to add all the existing equipment of the other facilities, which impacts the formula. Additionally, it impacts the timing by which asset owners can take advantage of the credit, as the repowering of units tends to happen sequentially across multiple months.

The answers to these important questions have never been clarified by the Treasury Department or the Internal Revenue Service, resulting in few hydropower owners utilizing this tax treatment.

WHAT NEEDS TO BE DONE?

National Hydropower Association (NHA) is attempting to gain additional clarity from the Treasury Department about potential benefits to hydropower under the IRA’s “Tech Neutral Credits,” which become effective January, 1, 2025, seeking the following clarifications in recently submitted comments.

- Hydropower, in all its forms, be found eligible for the tech neutral credits. Without this clarification, hydropower will not be eligible for 80/20 treatment after January 1, 2025.

- That only “equipment integral to the generation of electricity” be included in the calculation of the 80/20 rule. If agreed upon, this means that the costs of repowering one’s facility could be the basis by which taxpayers claim the credits. Real property, such as civil works and environmental improvements, would water down the calculation and limit eligibility for the credits; therefore, they would not be included in the calculation.

- The 80/20 Rule calculation would be done at the unit level, as opposed to the station level. Hydropower repowering tends to occur sequentially. In this case, hydropower owners could claim these credits as they go, avoiding years of waiting while equipment is repowered.

- NHA is seeking clarification on the eligibility of pumped storage. Currently, under the technology specific credits, which end December 31, 2024, pumped storage facilities are eligible to claim the production tax credit with an investment tax credit election.

However, a storage specific investment tax credit without an analogous production tax credit was created under the IRA. It is unclear if pumped storage is eligible for the tech neutral Production Tax Credits (PTC) starting in 2025; NHA requested pumped storage receive eligibility for PTC tax credits.

By clarifying these rules, NHA believes the outcome could be incredibly beneficial to the existing hydropower fleet, and the association will continue to advocate for clarified rules on the topic.

NEXT STEPS

NHA is in the process of scheduling meetings with multiple administration officials to discuss questions regarding the 80/20 Rule issue; for instance, this issue could materially improve the economics of replacing equipment in the powerhouse. NHA requests that companies with a vested interest in the 80/20 Rule reach out to policymakers to advocate for these changes.

NHA is also pushing for legislation, which would allow for an ITC (including an Elective Pay mechanism) that would improve the economics of dam safety and environmental enhancements, which are currently outside the scope of the 80/20 rule (as proposed by NHA).