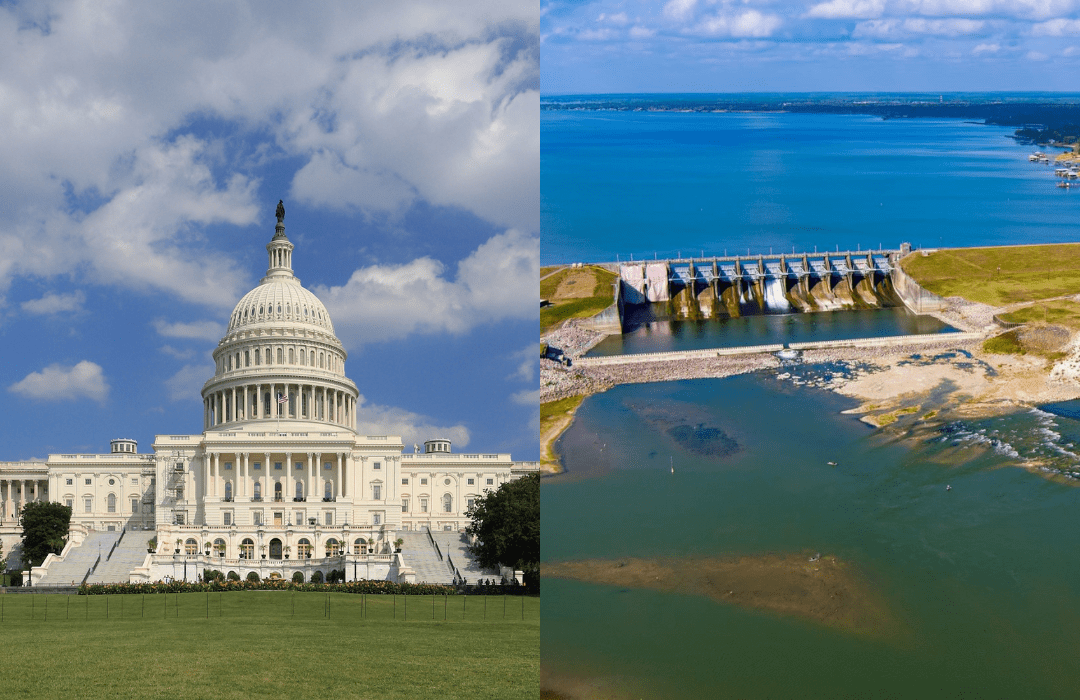

The Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL), which is also known as the Infrastructure and Investment Jobs Act (IIJA), could help transform the U.S. waterpower industry by supporting billions of dollars in investment in building new projects as well as maintaining and enhancing existing infrastructure.

Because the U.S. Department of Energy (DOE) and the U.S. Department of Treasury are still developing guidance for these programs, we don’t know everything about how these programs will function.

With the information we do have as of January 9, 2023, this article is intended to help readers develop a better understanding of how the programs work, recognize the differences between the two laws, and discover how industry can take advantage of the provisions.

BACKGROUND

In November 2021, President Biden signed the Infrastructure Investment and Jobs Act (IIJA) into law. This legislation, commonly known as the Bipartisan Infrastructure Law, provides $909 million for the waterpower industry through various grant and research and development (R&D) programs administered by the U.S. Department of Energy (DOE).

In August 2022, President Biden signed the Inflation Reduction Act into law. This legislation builds on the existing tax code to provide investment tax credits (ITCs) and production tax credits (PTCs), administered through the U.S. Department of Treasury, to the waterpower industry.

BIL = GRANTS ; IRA = TAX CREDITS

BIL’s Grants: The BIL funded the Section 242 and 243 hydropower incentive programs from the Energy Policy Act of 2005,and created the new Section 247 grant program for the waterpower industry. Hydropower asset owners will submit applications to the Department of Energy for eligible investments and, if approved, receive funding. There is a limited amount of funding available for these grant programs, so if they are oversubscribed, then applicants may not receive funding or receive the full amount for which they are eligible.

IRA’s Tax Credits: The IRA extended existing tax credits while also adding new ones for the waterpower industry. If a taxpayer makes an eligible investment, they will submit documentation and claim the value of the credit on their annual federal income tax return filed with the Internal Revenue Service (IRS). If the investment is approved, then the taxpayer will receive the value of the tax credit as a reduction of its income tax liability. Availability of the tax credits is not limited based on the amount of funding available.

- Investment Tax Credits (ITCs): Investment tax credits allow a taxpayer to reduce its taxable income based on a certain percentage of eligible investment costs. For example, if a taxpayer makes a $1,000,000 investment that is eligible for a 30% ITC, then the taxpayer reduces its tax liability by $300,000 (30% of $1,000,000).

- Production Tax Credits (PTCs): Production tax credits allow a taxpayer to reduce its tax liability based on the amount of electricity it generates. For example, if a hydropower facility is eligible for a $.025 per kWh PTC, and the owner of the facility (the taxpayer) generates 1,000,000 kWhs of electricity, then the taxpayer reduces its tax liability by $25,000 (1,000,000 x .025).

Direct Pay: The Inflation Reduction Act contains “direct pay” language, which allows organizations exempt from federal income tax (state or local government, the Tennessee Valley Authority, or any Alaska Native Corporation) to take advantage of the tax credit as a direct payment from the IRS.

Direct Pay and Domestic Content: Starting in 2024, projects taking direct pay must comply with the prevailing wage and apprenticeship requirements or their tax credit will be reduced. For projects that begin construction in 2024, the tax credit will be reduced by 10%; in 2025, the tax credit will be reduced by 15%. For projects beginning construction after 2025, the tax credit will be reduced to zero for direct pay projects that do not comply with domestic content and prevailing wage requirements.

There is an exception from the domestic content requirements for direct pay projects if complying with the domestic content provisions would increase the total cost of the project by 25%, or if there are not goods of sufficient quality or quantity for the project.

Transferability: Taxpayers claiming the ITC may choose to transfer their tax credits to other entities. Any amount paid for the transfer of a tax credit is not counted as taxable income. Partnerships or S corporations that hold assets qualifying for the ITC may transfer their tax credits, with the income from the tax credit being distributed to the partners/shareholders according to their distributed share of the partnership or S corporation.

WHAT ARE THE BIPARTISAN INFRASTRUCTURE LAW’S GRANTS FOR?

There are three main grant programs funded or created by the Bipartisan Infrastructure Law:

Section 242 for adding hydropower at existing non-powered dams:

- What type of investments are eligible? Capital investments that add hydropower generation at an existing non-powered dam or a conduit, and for new greenfield projects that are 20MW or less in areas of inadequate electric service.

- How much can a facility receive? A grant of up to $1 million a year. The grant is tied to the amount of hydropower generated by the retrofit of the non-powered dam or conduit, or by the development of a new greenfield project. Facilities may receive grants based on generation for up to 10 years.

- $125 million is available for the 242 program until it is expended. This amount is expected to provide several years of full funding for the program.

Section 243 for efficiency upgrades at existing hydropower facilities:

- What type of investments are eligible? Capital investments to improve the efficiency of a hydropower facility by 3% or more.

- Note: The Department of Energy has yet to clarify whether this means overall efficiency at the hydropower project or at an individual generating unit. A request for information (RFI) for the 243 program was issued in the fall of 2022, and further guidance, with additional details, are expected in the first half of 2023.

- How much can a facility receive? A grant (up to 30% of capital improvements capped at $5 million a year per facility).

- $75 million is available for the 243 program until it is expended.

- Note: It is unclear how long this funding will last as it will depend on the number of projects that apply, which could also reduce individual facility awards.

Section 247 for grid resilience, dam safety upgrades, and environmental enhancements at existing hydropower facilities:

- What type of investments are eligible? The Bipartisan Infrastructure Law laid out specific investments at hydropower facilities that should be eligible for grants.

- Grid resiliency includes:

- adapting more quickly to changing grid conditions

- providing ancillary services (including black start capabilities, voltage support, and spinning reserves)

- integrating other variable sources of electricity generation

- managing accumulated reservoir sediments

- Dam safety includes:

- the maintenance or upgrade of spillways or other appurtenant structures

- dam stability improvements, including erosion repair and enhanced seepage controls

- upgrades or replacements of floodgates, natural infrastructure restoration, or protection to improve flood risk reduction

- Environmental improvements include:

- adding or improving safe and effective fish passage, which includes: new or upgraded turbine technology, fish ladders, fishways, and all other associated technology, equipment, or other fish passage technology to a qualified hydroelectric facility

- improving the quality of the water retained or released by a qualified hydroelectric facility

- promoting downstream sediment transport processes and habitat maintenance

- improving recreational access to the project vicinity, including roads, trails, boat ingress and egress, flows to improve recreation, and infrastructure that improves river recreation opportunity

- NOTE: As this is a new program established under the Bipartisan Infrastructure Law, the DOE is currently in the process of implementing the program. A request for information (RFI) was issued in the fall of 2022 and further guidance with additional details is expected in the first quarter of 2023.

- Grid resiliency includes:

- To be eligible, projects must be in compliance with all applicable federal, tribal, and state requirements, or be brought into compliance as a result of the capital improvements carried out with the incentive payment.

- How much can a facility receive? Grants up to 30% of capital expenditures are capped at $5 million a year.

- $553 million in funding is available for the 247 program until it is expended.

- Note: It is unclear how long this funding will last as it will depend on the number of projects that apply, which could also reduce individual facility awards.

WHAT ARE THE IRA’S TAX CREDITS FOR?

Extension of Existing Hydropower and Marine Energy PTC and ITC, with PTC Credit Rate Parity (Years 2023 – 2024)

- What types of investments are eligible for a tax credit? Capacity upgrades at existing hydropower facilities, adding generation to non-powered dams, and new marine energy and hydrokinetic projects with a capacity of greater than 25 kilowatts (kWs) are eligible for a production tax credit at the full credit rate. Taxpayers may elect to take an ITC instead of the PTC.

Technology-Neutral Clean Energy Generation Tax Credit (Years 2025 – 2032)

- What types of investments are eligible for a tax credit? Starting in 2025, the existing renewable energy tax credits transition to technology-neutral clean energy credits. Projects that meet the following criteria may elect to take either a PTC or an ITC, but not both. For an electricity generation resource to qualify for a tax credit, the project must be:

- Used for the generation of electricity

- Placed in service after Dec 31, 2024

- One for which the anticipated greenhouse gas emissions rate is not greater than zero (as determined by the Secretary of the Treasury)

- This technology-neutral energy generation tax credit also applies to capacity upgrades and new units at existing non-greenhouse gas emitting electricity generation facilities placed in service after December 31, 2024. As hydropower, marine energy, and hydrokinetic projects are all non-greenhouse gas emitting forms of electricity generation, they should all be eligible for this new PTC or ITC.

Energy Storage Tax Credit

- What types of investments are eligible for a tax credit? The IRA creates a new technology-neutral 10-year energy storage ITC through the end of 2032. The energy storage ITC applies to new energy storage projects, including pumped storage projects, or capacity upgrades at existing energy storage projects with a capacity greater than 5 kilowatt hours (kWh).

HOW DO THE INFLATION REDUCTION ACT’S TAX CREDITS WORK?

PTC Payment Structure

The base rate for the production tax credits in the IRA is an inflation adjusted 0.3 cent per kWh of generation. Projects that comply with prevailing wage and apprenticeship requirements multiply the tax credit by five. Since the inflation-adjustment rate is calculated from 1990, the credit becomes 2.6 cents per kWh (in 2022) once the inflation-adjustment is factored in.

ITC Payment Structure

The base rate for the investment tax credits in the IRA is 6%. Projects that comply with prevailing wage and apprenticeship requirements multiply the tax credit by five, which makes the total value 30%.

Prevailing Wage and Apprenticeship Requirements

As part of the Democrats’ commitment to supporting living-wage jobs for American workers, and to create opportunities for new workers in the clean energy sector, the IRA includes a new prevailing wage and apprenticeship framework. For projects to multiply their tax credit by five, they must comply with the following requirements:

- Prevailing Wage: Workers building and maintaining facilities must be paid the prevailing rates for the area in which the project is located. The prevailing wage for a given locality will be determined by the Secretary of Labor.

- Apprenticeship requirements: Starting in 2022, a set percentage of the labor hours constructing facilities must be completed by qualified apprentices. The percentage of labors hours completed by apprentices must be at least the following:

-

- 2022: 10%

- 2023: 12.5%

- 2024 onward: 15%

- Recognizing that there may not be apprentices available for a project, the IRA includes a good-faith exception for projects that request qualified apprentices from a registered apprenticeship program but do not receive a response in five business days, or for when no apprentices are available. The Secretary of Treasury has promulgated rules for the Prevailing Wage and Apprenticeship requirements, which can be found here.

IRA’s Bonus Tax Credits

Domestic Content Bonus Credit: Projects that use 100% American steel and iron, and meet the applicable manufactured goods requirements, will be eligible to increase their credit by 10% if they are claiming the PTC or 10 percentage points if they are claiming the ITC.

- Iron and Steel: The IRA specifies that iron and steel must be compliant with the Federal Transit Administration’s Buy America regulations. Those regulations require that all iron and steel used in a project must be manufactured in the United States.

- Manufactured goods: The manufactured goods provision calls for a set percentage of manufactured components that go into a project to be mined, produced, or manufactured in the U.S. From 2022 to 2024, 40% of manufactured goods must be from the U.S. The percentage increases to 45% in 2025, 50% in 2026, and then tops out at 55% from 2027 onwards.

- Domestic Content Bonus for PTC v. ITC: The domestic content bonus is different for projects taking the Investment Tax Credit and the Production Tax Credit. A taxpayer that meets the prevailing wage and apprenticeship requirements, satisfies the domestic content provision, and elects to take the ITC will be eligible for a 40% ITC (a 10 percentage point bonus on a 30% ITC). A taxpayer that meets the prevailing wage and apprenticeship requirements, satisfies the domestic content provision, and elects to take the PTC, will receive an inflation adjusted 2.86 cents per-kWh PTC (a 10% bonus on 2.6 cents per-kWh credit).

Energy Community Bonus Credit: Projects located in “energy communities” are eligible for a bonus tax credit as well.

Energy communities are defined as any of the following:

1) a brownfield site;

2) an area which has (or, at any time after December 31, 1999, had) significant employment related to oil, gas, or coal activities;

3) a census a census tract or any adjoining tract in which a coal mine closed after December 31, 1999; or

4) a census a census tract or any adjoining tract in which a coal-fired electric power plant was retired after December 31, 2009.

The threshold for “significant employment” in carbon-based forms of energy activities is not defined in the IRA and will be determined by the Secretary of Treasury.

Energy Community Bonus Credit for ITC v. PTC: The energy community bonus is different for projects taking the Investment Tax Credit and the Production Tax Credit. For projects electing to take the ITC, the bonus is 10 percentage points. For example, an ITC project that complies with prevailing wage and apprenticeship provisions, and is located in an energy community, would receive a 40% ITC. An ITC project that does not comply with prevailing wage and apprenticeship provisions, but is located in an energy community, would receive a 16% ITC.

For projects taking the PTC, the bonus is 10% of the value of the PTC. For example, a PTC project that complies with prevailing wage and apprenticeship provisions, and is located in an energy community, would receive an inflation adjusted 2.86 cents per-kWh PTC (a 10% bonus on 2.6 cents per-kWh credit).

WHAT’S NEXT FOR THE BIL GRANTS AND IRA TAX CREDITS?

BIL Grants: DOE plans on releasing draft guidance for the 243 and 247 programs in the first quarter of 2023. Issuance of final guidance and applications for funding under these programs would open soon thereafter.

IRA Tax Credits: projects may currently claim the IRA tax credits. Treasury and the IRS will continue to release guidance documents and proposed rules for the tax credits on an ongoing basis.

Note for Manufacturers: The IRA also included funding for the 48C investment tax credit for re-equipment of facilities. More details about this tax credit can be found here.