With 2024 underway, the water power industry can expect to see significant announcements for finalized federal regulations in several key policy areas.

From late spring to early summer, the final guidance for tax credits in the Inflation Reduction Act (IRA), as well as major rules for the Endangered Species Act and the National Environmental Policy Act (NEPA), are anticipated to come into effect, and there are major implications for the energy sector at large, including the 5th Circuit Court litigation on the recent Clean Water Act Section 401 final rulemaking underway this year.

Given these impending changes, the water power industry must understand both the current state of these regulations, as well as where they’re headed, in order to ensure that the industry’s priorities and interests are represented.

UNDERSTANDING THE TIMELINE

The proposed timeline is based on precedent for how the presidential transition impacts federal rulemaking; specifically, the Congressional Review Act (CRA) is a 1996 law, which allows Congress to overturn rules, guidance, and memoranda issued by federal agencies within 60 in-session days of the rule’s submission.

During the beginning of the Trump Administration, the CRA was used to nullify 15 rules, but prior to that, it had only been used once. Thus, it is expected that the Biden Administration will attempt to finalize guidance for outstanding rules in late spring to early summer of 2024, protecting them from potential nullification.

As a result, all eyes are on agencies like the Department of Treasury (Treasury), the U.S. Fish and Wildlife Service, National Marine Fisheries Service, and the Council on Environmental Quality to see how they will finalize their outstanding rules in the following months.

TAX CREDITS IN 2024

Section 48

In August 2022, President Biden signed the Inflation Reduction Act (IRA) into law. This legislation, which builds on the existing tax code to provide investment tax credits (ITCs) and production tax credits (PTCs), administered through the U.S. Department of Treasury, to the water power industry.

The Section 48 ITC allows an existing qualified hydropower facility, which has invested in efficiency improvements or capacity additions to, in lieu of PTC treatment for incremental production, elect for ITC treatment on the energy property. The base credit is 6% of the value of the energy property, and it can reach up to 30% if beginning construction, prevailing wage, and apprenticeship requirements are met. Additionally, bonus credits are also offered for meeting domestic content and energy community requirements, both at 10%.

If fully leveraged, these credits could provide billions of federal dollars to the water power industry while completely reshaping the viability of upgrade projects for existing assets across the country.

A Notice of Purposed Rulemaking (NOPR) for the Section 48 ITC was released by Treasury in November 2023. Among other things, the NOPR sought to clarify the scope of what exactly is considered a “unit of energy property.” Treasury defined energy property as “functionally interdependent” components capable of operating apart from other property within a larger project; also, pumped storage was confirmed as an energy storage property, deeming it eligible for ITC treatment.

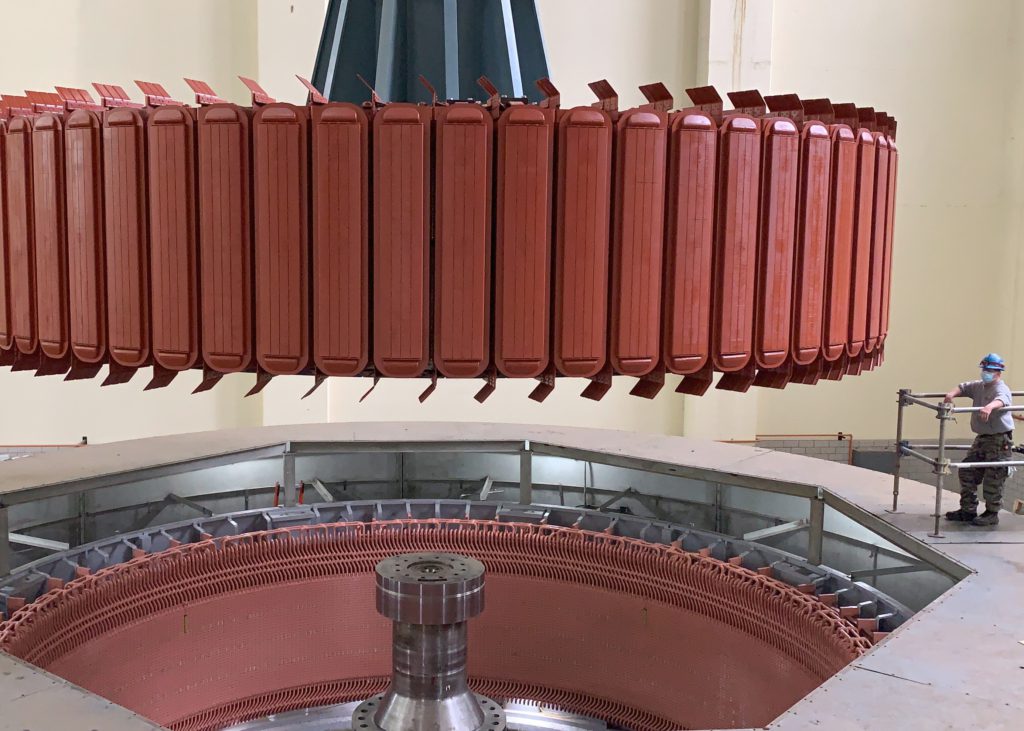

These clarifications were a step in the right direction for the hydropower industry. However, unlike other renewables, Treasury did not provide any specific examples of a unit of energy property for hydropower facilities. As a result, existing hydropower asset owners are still unsure if they will receive ITC for repowering their electro-mechanical equipment as “unit of energy property” under the 80/20 Rule.

Answering this question carries particular importance for hydropower as it relates to the application of the 80/20 Rule, which allows a taxpayer to claim an existing facility as new if the fair market value of any retrofit equipment is at least 80% of what is left over. Yet, it remains unclear as to whether the civil works parts of a hydroelectric facility, like the dam, reservoir, etc., would be included in the fair market value of existing property. Operating under this interpretation would create a large hurdle for taxpayers looking to use the 80/20 rule.

NHA filed comments on the Section 48 NOPR on January 22, 2024, asking Treasury to provide hydropower specific examples of energy property, confirmation of the 80/20 rule for hydropower, and the scope of eligible property for pumped storage. The comments also sought confirmation that marine energy property, a key technology in the future of renewable energy, is eligible for ITC treatment – similar to offshore wind. Finalized guidance is expected within the year.

Domestic Content and Elective Pay

Last summer, Treasury also released notices of purposed rulemaking on both Domestic Content requirements and Elective Pay for the Section 45 and Section 48 tax credits.

Domestic content is a 10% bonus to the base ITC and PTC for taxable entities which domestically source steel, iron, manufactured products, and unmanufactured materials. However, for nontaxable entities, meeting domestic content is a requirement for eligibility, not a bonus incentive.

Given that nearly half of all hydropower asset owners are federal entities, and many more are public power producers, ensuring that finalized guidance is favorable to the hydropower industry is crucial. NHA submitted comments to the NOPR in August of last year to identify several concerns with Treasury’s implementation guidance, ranging from how to classify onsite manufacturing to determining how to measure direct manufacturing costs.

Elective Pay is an option that allows nontaxable entities (i.e., Applicable Entities) like public power to claim these tax credits in the form of a cash rebate. The NOPR for Elective Pay was released last summer. NHA responded in August 2024 with a request that Treasury ensure the eligibility of federal agencies that own, operate, and or market hydropower, which includes agencies like the United States Army Corps of Engineers, the U.S. Bureau of Reclamation, and the four regional Power Marketing Administrations (PMA).

Given that the PMAs are mostly funded through sales to customers and not appropriations, the need to ensure that they benefit from the IRA’s historic investments is vital. Applicable Entities can take advantage of the IRA’s credits on projects that are placed in service after December 31, 2022. Domestic Content requirements for Applicable Entities begin for projects that commence construction on January 1, 2024. Starting January 1, 2026, Applicable Entities will need to abide by Domestic Content requirements to receive any benefits.

REGULATORY CHALLENGES IN 2024

Beyond the Inflation Reduction Act, the water power industry should be aware of several upcoming environmental rulemakings, as they have wide-reaching consequences for the water power industry. These proposed rules by U.S. Fish and Wildlife Service (USFWS), National Marine Fisheries Service (NMFS), and the White House Council on Environmental Quality (CEQ) seek to broaden the scope of agency authority in ways that conflict with industry interests and the law. In 2024, NHA expects that these rules will be finalized.

The Endangered Species Act

In June of 2023, USFWS and NMFS proposed a rule to modify the Section 7 interagency consultation regulations in The Endangered Species Act (ESA). The ESA is important to the protection and conservation of endangered species and their habitats. While the water power industry shares in the ESA’s goals and invests significant resources towards efforts like fish passage and restoration, NHA believes the Services’ proposed rule is an overreach of authority that unduly burdens hydropower owners and operators.

The proposal essentially redefines when the Services can require environmental mitigation measures, allowing unilateral agency authority to impose mitigation even in no-jeopardy biological opinions. Under these rules, the Services could reinitiate the consultation process regardless of whether the hydropower asset owner is not in a licensing action. NHA argues that this change goes against Congressional intent for the ESA and is contradictory to the Services’ long-standing precedent.

Furthermore, the rule permits the Services to use their own discretion to determine whether an existing facility is part of an environmental baseline or considered an effect of a proposed action. NHA believes this provision is in contrast to the clear intent of the law and is inhibiting for non-powered dam developers looking to add turbines to an existing facility or relicensing existing facilities. The arbitrary and capricious rules would impede the growth of new water power while subjecting existing facilities to scrutiny beyond reason.

NHA submitted comments alongside the Northwest Hydroelectric Association (NWHA) in August of 2023, highlighting these concerns. This final rule will be an important development to watch for in 2024, especially in conjunction with finalized guidance for the tax credits.

National Environmental Policy Act (NEPA) Phase II

Another large development is coming in 2024, the final rulemaking from the White House Council on Environmental Quality (CEQ) regarding NEPA Phase II. In July of 2023, the Biden Administration opened the proposed rule for comment in an effort to streamline the NEPA process and expedite the advancement of renewable energy.

Unfortunately, much of the proposed changes to NEPA add cumbersome requirements that would, in practice, slow the development of clean resources like hydropower. For one, CEQ’s proposition prevents agencies from using existing data and resources to make informed decisions. Ultimately, this would result in agencies conducting long, duplicative studies in isolation from the larger scientific community, exacerbating the already long lead time for hydropower, and potentially depressing investment into the water power industry.

Second, these rules would require agencies like the Federal Energy Regulatory Commission (FERC) to broaden the environmental impact analyses for proposed facilities beyond the project area to regional, national, and global environments. These vague requirements reduce regulatory certainty and only serve to amplify the licensing burden carried by hydropower developers.

The United States cannot reach the Biden Administration’s climate goals without the clean and reliable contributions of hydropower. These proposed modifications to NEPA are confusing, misleading, and create even larger hurdles to licensing new hydropower. NHA submitted comments to CEQ in September of 2023 and expects a final rule to be promulgated this spring or early summer.

Clean Water Act 401

The final regulatory development to watch in 2024 is the upcoming litigation on the Clean Water Act Section 401. The Environmental Protection Agency (EPA) released the final rule on 401 in September of 2023. The EPA’s rulemaking expanded regulation of water quality beyond the point of discharge and into larger effects of operation.

In response, NHA and numerous other parties requested a preliminary injunction in the 5th Circuit Court of Louisiana with the hope of staying the rule. The preliminary hearing is scheduled for March 5, 2024. Realistically, the case will evolve well into 2024 while carrying important implications for hydropower operations.

NEXT STEPS

It is important that the water power industry stay informed as these rules and regulations are finalized throughout 2024, adapting accordingly. Readers are encouraged to monitor updates from federal agencies and NHA, especially in late spring and early summer when announcements are anticipated. NHA encourages readers to submit public comments of their own on proposed rules.

For more information, stay connected with NHA’s Regulatory Affairs committee, which hosts monthly meetings and informative webinars covering these outstanding issues. For those planning to attend Waterpower Week, consider attending the Regulatory and Legal Hot Topics session for up-to-the-minute updates on the industry’s most pressing regulatory issues and legal cases.