Hydrogen is being touted as an optimal energy solution for its role in decarbonization, but where does hydropower fit in? Green hydrogen can be produced from renewable energy sources, and the benefits of its production range from improving U.S. energy security to broad applicability across transportation, commercial, and industrial sectors.

Yet, the biggest challenge facing hydrogen production, especially as it relates to renewables like hydropower, is how to provide it at a lower cost. Currently, most hydrogen is produced from natural gas, but the demand for green hydrogen is growing.

Section 45V Hydrogen Production Tax Credit in the Inflation Reduction Act (IRA) is but one example of the increased investment in green hydrogen. This tax credit awards up to $3 per kg of hydrogen produced to projects with low lifecycle greenhouse gas emissions intensity.

By understanding the Hydrogen Production Tax Credit, hydropower owners and operators can help the U.S. achieve its clean energy goals while integrating hydrogen into their energy portfolios.

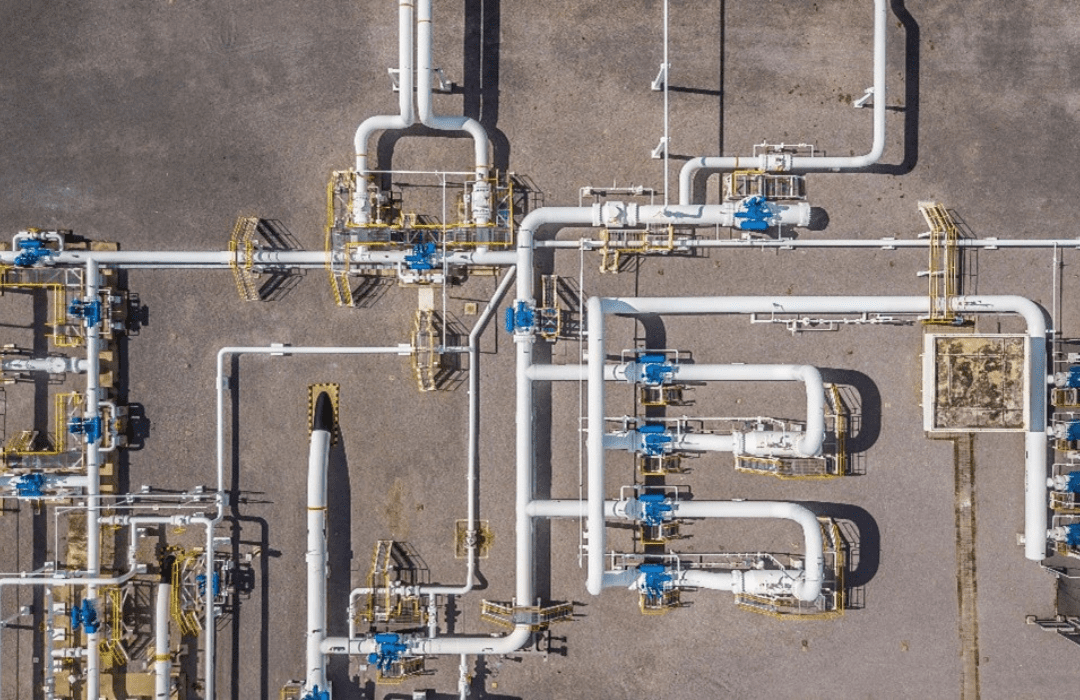

Top-down view of hydrogen production facility.

UNDERSTANDING THE HYDROGEN PRODUCTION TAX CREDIT

To better understand what the Section 45V Hydrogen Production Tax Credit entails, it’s important to gain clarity about what is being discussed when the term “qualified clean hydrogen” is used. First, the use of “qualified clean hydrogen” refers to a project that produces greenhouse gas emissions not exceeding 4kg of CO2 per kg of hydrogen, and the corresponding tax credits are then organized in four tiers, which reward a greater tax credit to those who produce a considerably cleaner form of hydrogen.

- The first tier provides a 20% applicable percentage when the emissions rate ranges from 4kg to 2.5kg of CO2 per kg of hydrogen.

- The second tier provides 25%, with emissions ranging from 2.5kg to 1.5kg of CO2 per kg of hydrogen.

- The third tier provides a 33.4% applicable percentage when the emissions rate ranges from 1.5kg to 0.45kg of CO2 per kg of hydrogen.

- Finally, the largest applicable percentage is 100%, which is when the emissions rate is less than 0.45kg of CO2 per kg of hydrogen.

In addition, there are several issues that the Department of Treasury and the Internal Revenue Service need to address to implement the Section 45V Production Tax Credit, and those issues are additionality, deliverability, and time-matching.

- Additionality refers to the requirement of clean electricity for hydrogen production to originate from new, clean generation sources, uprating of existing clean generation, or curtailed electricity.

- Deliverability ensures that electrolyzers – devices that uses electricity to split components into their constituent elements through electrolysis – source clean electricity from within their operating region to minimize the dispatching of emissions-intensive marginal generation resources.

- Time-matching requires electrolyzers to match their electric consumption with clean energy production down to a certain time range (e.g., annual, hourly, etc.).

ASSESSING THE STANDARDS

Currently, there is an ongoing debate regarding the aformentioned standards. Certain groups argue that without strict standards, electrolytic hydrogen projects could end up emitting significantly more greenhouse gas emissions than current unabated fossil fuel-based production methods. Others argue that this nascent industry needs flexibility or else the intent of the legislation which is for this industry to mature will never come to fruition.

Concerns have been raised by hydrogen developers and energy companies in response to the additionality requirements, as the concerned parties believe that additionality requirements would impose undue costs, limit decarbonization viability, and inhibit implementation practicality. The National Hydropower Association continues to oppose any additionality requirements.

A study by Argonne National Laboratory found that annual matching can result in lower carbon emissions than hourly matching in many scenarios. However, this study only accounts for attributional emissions and fails to consider consequential emissions, which results in an overbuilding scenario that does not address electricity market demand forces.

Additional challenges also exist in implementing hourly matching but calls for a phased-in approach have emerged, focusing on regional market deliverability, annual matching, and easy-to-implement additionality requirements as initial guidelines.

An article written by the Center for Strategic & International Studies recommends looking at the hydrogen incentive strategies implemented by international players for guidance. The European Commission, for example, has released definitions and phased-in approaches to renewable hydrogen standards. While Japan, Australia, Canada, and India have also taken steps to support hydrogen production and electrolyzer technology.

An example of an electrolyzer being used to make clean hydrogen

Furthermore, the Center for Strategic & International Studies’ article highlights the importance of ramping up electrolyzer deployment in the short term to reduce electrolytic hydrogen costs and meet forecasted hydrogen demand. However, the long-term priority is ensuring clean hydrogen through hourly matching with clean electricity resources.

A phased-in approach with clear guideposts and timelines for increased stringency is recommended to signal to developers, both domestically and internationally, and to ensure the effectiveness of hydrogen as a decarbonization pathway.

FOR MORE INFORMATION

The United States faces an important decision in implementing the Section 45V Hydrogen Production Tax Credit. It is imperative to determine both the proper standards and the best way to support renewable energy.

To learn more about the issues discussed in this article, the following pieces provide further insight:

- The Battle for the US Hydrogen Production Tax Credits

- Biden Pressed to Limit Hydrogen Credits Key to New Industry

To read the Hydrogen Tax Credit in full, visit this link.