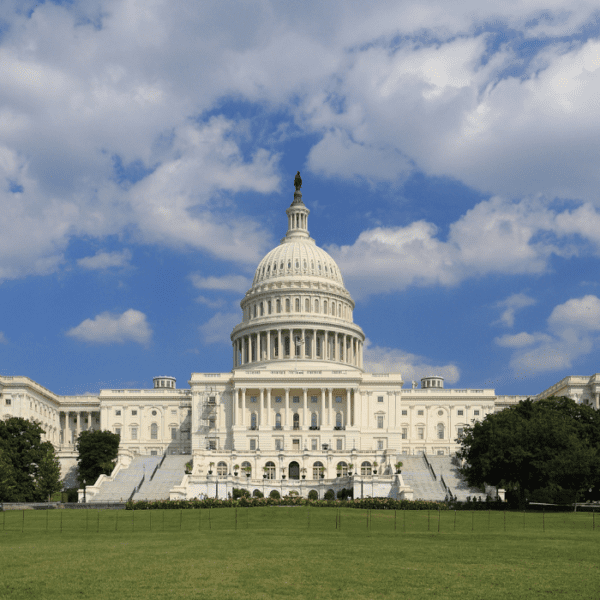

The U.S. has long used targeted tax credit programs to incentivize investment and innovation in the energy sector. This is true for fossil and renewable resources alike. Tens of thousands of jobs and billions of dollars in private investment across industries — not to mention the additional of affordable, reliable, and renewable power — have been driven by tax credit policies.

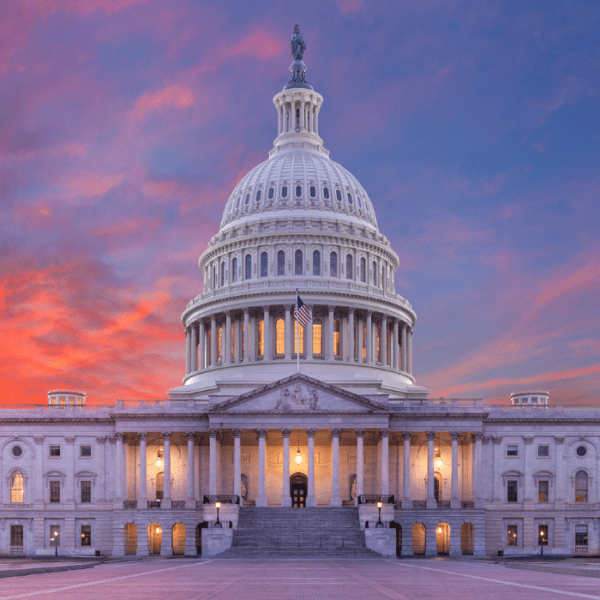

When President Biden introduced his Infrastructure plan in March of 2021, he emphasized that he wants the U.S. electric power industry to be emissions–free by 2035. One of the key pillars of the plan that will meet the carbon-free goal is the commitment to continue the production tax credit (PTC) and the incentive tax credit (ITC) by proposing a 10-year extension and a phasedown of an expanded direct-pay ITC and PTC for clean energy generation and storage.

Biden’s plan also includes assurance that these credits will be paired with strong labor standards to ensure the jobs created are “good-quality jobs with a free and fair choice to join a union and bargain collectively.”

NHA is calling for the tax-credit portion of the plan to include waterpower. Specifically, NHA is calling for: 1) a long-term extension of the existing PTC and ITC for incremental and new hydropower, 2) a new technology neutral credit for storage, including pumped storage, and 3) a new credit to incentivize existing hydropower facilities to invest in projects with public benefits, such as environmental improvements, dam safety, grid flexibility/availability, or dam removals with the owner’s consent.

THE DEEP DIVE: HISTORY OF TAX CREDITS FOR WATERPOWER

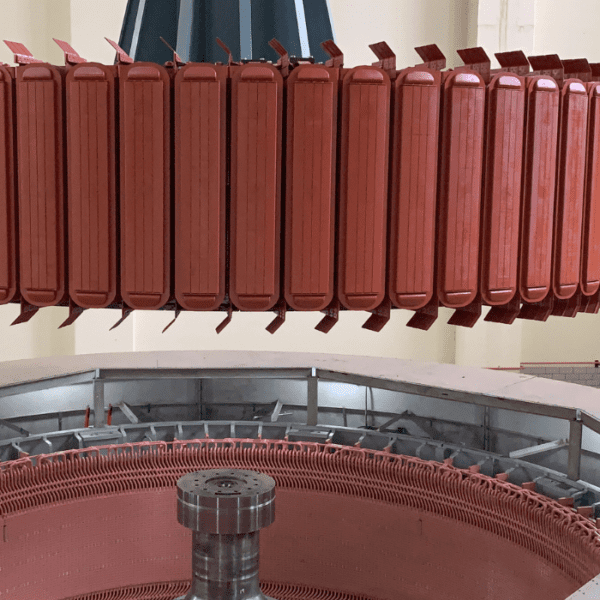

Hydropower was first made eligible for production tax credit (PTCs) under section 45 of the Energy Policy Act of 2005. Eligible for the credits were existing facilities where investment was being made to add capacity or improve efficiency. The credits also were extended to investments in new hydro at existing dams. With the PTC, tax credits were based on the production of electricity at the eligible facility. The PTC was available for ten years, starting when the project is placed in service.

In 2008, marine energy resources were added.

Under the American Recovery and Reinvestment Act in 2009, hydropower and marine energy facilities could also elect to take the investment tax credit (ITC). The ITC is based on the amount of money invested to construct the facility.

Approximately 170 hydro projects have received tax credits, estimated to be worth $10 million to $35 million annually.

To put those credits in perspective, wind and solar projects are receiving more than $1 billion annually in tax credits.

INSIGHTS ON CURRENT TAX CREDIT-RELATED LEGISLATION

Before 2020 wrapped up, Congress in December passed the omnibus bill, which provided significant direct value opportunities across the waterpower sector through tax credits. The bill provides a 1-year extension of both the PTC and ITC through 2021 at existing credit rates for qualifying hydropower and marine energy resources.

That means hydropower receives half-credit rate under the PTC (approximately 1.3 cents per kilowatt–hour), and the full 30 percent rate under the ITC.

Disappointingly, there is not a mention in the 2020 law of providing federal tax incentives to support the deployment of new energy storage resources, including pumped storage hydropower.

Furthermore, in the 2020 law, waterpower is not receiving the same incentives as the wind and solar industries. The wind industry received the same one-year extension, but with a 40 percent reduction to both the PTC and ITC credit rates; while solar got a two-year extension of its ITC through 2023, though still with the phasedown applied.

This disparity puts hydropower development at a significant competitive disadvantage, particularly in the eyes of investors who are seeking clarity and certainty.

Today, there are several bills currently making their way through Congress, which address extension of tax credits for the electricity sector, each of which has different timelines and values for the credits themselves.

Here’s two examples:

- The Growing Renewable Energy and Efficiency Now (GREEN) Act of 2020 includes a five-year extension of the PTC for wind at 60 percent of the full value through 2026; a 30 percent ITC for solar and energy storage through 2026, decreasing to 10 percent by 2028; and a 30 percent ITC for offshore wind through 2028.

- The Clean Energy for America Act, a technology-neutral tax credit proposal, extends the PTC for wind and solar at the full value, and includes a 30 percent ITC for new renewables, storage, nuclear, and carbon capture and storage (CCS). The credits would be set to phase out when emissions targets are achieved.

WHAT’S NEXT?

For the waterpower industry, the National Hydropower Association (NHA) is advocating for technology-neutral tax credits that will level the playing field for all renewable and storage technologies.

Currently, the PTC and ITC are set to expire at the end of 2021. NHA is calling on Congress to adopt a long-term extension of the PTC and ITC, with a direct pay option, for hydropower and marine energy projects.

NHA also is proposing a new 30 percent ITC for hydropower environmental and dam safety infrastructure expenditures, including costs associated with dam removals at existing facilities.

This proposal includes an election to make the credit refundable by treating the full amount as an estimated tax payment, allowing entities with little or no tax liability (such as public power project owners), to utilize the credit. This new credit is needed to incentivize because existing hydropower projects to accelerate investments that provide public benefits, such as environmental improvements, dam safety, grid flexibility/availability, or removal of dams that the owner determines no longer serves a purpose. Such a tax credit is critical to preserving the 80 GW of existing carbon-free hydropower capacity, which would reduce accumulative greenhouse gas (GHG) emissions by 5.1 billion metric tons by 2050. The timing is critical since roughly 30% of FERC regulated hydropower facilities are up for relicensing over the next decade.

Finally, NHA is advocating for a technology–neutral ITC to level the playing field for new advanced pumped storage to compete against other storage technologies. With the inclusion of pumped storage defined as an energy storage technology, it would allow the technology to qualify for federal tax incentives.

“By passing such incentives, Congress will ensure the public benefits provided by a variety of waterpower technologies – conventional hydro, pumped storage, and marine energy – are maintained, and grow … ultimately helping to meet the goal of a clean energy future,” says Malcolm Woolf, president and CEO of NHA.