The U.S. International Trade Commission (ITC) released a report on the economic and environmental benefits of imported hydropower from Quebec to New England. Though the report includes many key takeaways and case studies demonstrating hydropower’s critical role in decarbonization, the report’s findings with regards to hydropower greenhouse gas emissions (GHG) are especially timely.

The report finds that hydropower does not directly produce GHG emissions and can reduce emissions by replacing natural gas. Though concerns have been raised regarding methane production from plant decay in some hydropower reservoirs, the report finds that reservoirs of concern are “in tropical regions with a large amount of vegetation” and are “reportedly highest within four years” of reservoir construction.

These findings come on the heels of the Democrats in the U.S. House of Representatives introducing the Clean Futures Act, which counts all existing hydropower, wind, and solar as zero carbon, but includes a provision to study methane emissions from new hydropower reservoirs.

Hydro Quebec has compiled the following complete analysis of the report and key takeaways beyond GHG reduction.

The following insights were compiled by Hydro-Quebec

On February 25, 2021, the U.S. International Trade Commission (ITC) released the report requested by the Ways & Means Committee of the U.S. House of Representatives on January 23, 2020.

The report, which was made public and formally delivered to the requesting Congressional committee on February 25, 2021, contains four chapters:

- The first chapter provides a background on electricity generation, markets and regulations that impact those markets.

- The second chapter examines electricity markets in New England, focusing on conditions within Massachusetts as well as the transition of the regional grid toward renewable energy.

- The third chapter provides the quantitative analysis of the economic and greenhouse gas (GHG) emissions impact of the Massachusetts Renewable Energy Portfolio Standard (RPS) and Clean Energy Standard (CES).

- The final chapter contains case studies of cross-border hydroelectricity trade, focused on the economic and GHG emissions impact of that trade.

Notably, the report is largely favorable with regard to both the economic and GHG emissions impact of hydropower.

Congressman Richard Neal (D-MA), who requested the report, issued a short statement praising the report in which he stated:

As I have said throughout my career, there must be an ‘all the above’ approach when addressing our energy portfolio. I have supported and continue to applaud industry decisions to pivot away from the burning of coal and use of nuclear power. However, when we move away from one energy source, there must be reliable, economical, and adequate alternatives for the millions of homes and businesses in Massachusetts. This study shows that with a collaboration of wind, solar, hydroelectricity, and other renewable, clean options, Massachusetts and New England will be able to meet its commitments to reduce its carbon footprint and keep homes and businesses with power. (emphasis added).

Chapter-by-Chapter Overview and Key Takeaways

Chapter 1 – Introduction and Background on Electricity Markets

In this chapter, the ITC explains its approach to this investigation and provides background on electricity markets, including how prices are determined, generation types – walking through fossil fuel, nuclear, and renewable (solar, wind, hydroelectric, biomass) generation, and federal regulation that impacts electricity market operations and planning.

Key Takeaways:

- The report describes hydropower as a renewable energy source in the introduction.

- The summary of pricing and emissions issues may be useful as a U.S. government source for such information.

Chapter 2 – Overview of Electricity Markets in New England and Massachusetts

This chapter examines electricity markets in New England, with an in-depth focus on conditions within Massachusetts (for 2010-2019) as well as the regional grid’s transition toward higher shares of renewable energy.

Key Takeaways:

- Among the key finding are:

- Massachusetts electricity prices are among the highest in the United States

- The New England states are on track to meet RPS and CES commitments

- Renewable electricity generation in the region is likely to grow

- Increased imports of hydroelectric energy from Canada will likely support Massachusetts’s carbon emissions reduction goals and help it meet its CES requirements

- The chapter provides a useful summary of generation sources and trends in the region and summarizes the various renewable and clean energy policies in the New England states.

Chapter 3 – Quantitative Analysis

This chapter presents the ITC’s quantitative analysis of the potential economic effects on Massachusetts and New England of reaching their increased renewable energy goals and commitments, such as potential price changes for residential and commercial consumers of electricity.

The request from the Ways & Means Committee required the ITC to quantify the effects of Massachusetts’s renewable energy commitments on costs to consumers and GHG emissions.

Using forecasts from the U.S. Energy Information Agency Annual Energy Outlook, the ITC modeled consumer costs under various scenarios as well GHG emissions. The model did not take into consideration Hydro-Québec’s long-term contracts with Massachusetts.

Key Takeaways:

- The ITC’s quantitative analysis concluded that Massachusetts Renewable Energy Portfolio Standard (RPS) and Clean Energy Standard (CES) would create a small cost increase for Massachusetts consumers of between 0 and 0.12 cents per kilowatt-hour — resulting in potential increased costs to residential consumers of $0.76 per month and $5.57 per month for commercial customers.

- The ITC found that the RPS and CES would reduce wholesale generation costs for consumers in the remainder of New England by incentivizing additional generation capacity.

- The model found that the RPS and CES reduce emissions from electricity generated for consumption in Massachusetts by 1.94 million metric ton (mt) per MWh annually between 2030 and 2035 and 1.91 million mt annually between 2035 and 2040. After 2040, the model finds no GHG emission reduction due to the policies because clean energy and renewables no longer require incentives to compete after 2040.

- The quantitative analysis finds that imports of hydroelectricity are projected to play an important role in satisfying demand in New England and ensuring that Massachusetts meets its clean energy commitments.

- The model concludes that removing Massachusetts’s access to imports from Canada and New York more than doubles the costs of meeting the RPS and CES commitments in the earlier years, when incentives are necessary for renewables.

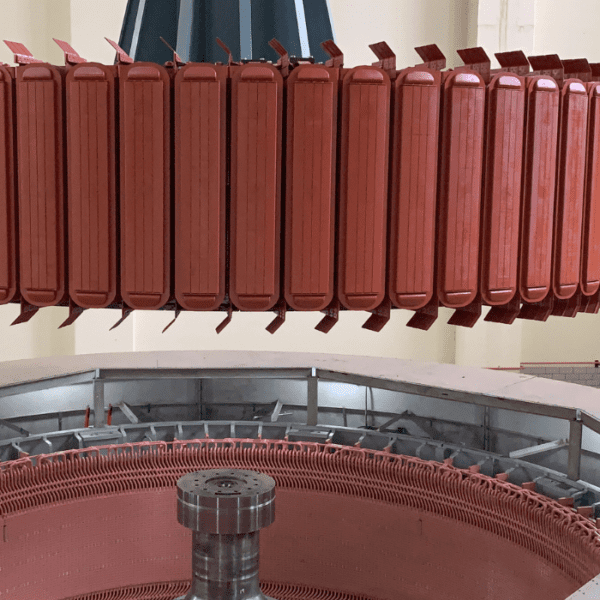

Chapter 4 – Case Studies of the Effects of Imports of Hydroelectricity

This chapter describes the effects of imported hydroelectricity in other markets, through case studies on such trade in the U.S. Columbia River Basin, New York State, the Minnesota-Manitoba region, and Denmark.

The Ways & Means Committee requested the inclusion of these case studies on the potential economic effects of imports of hydroelectricity.

Key Takeaways:

- The case studies highlight the costs-benefits from hydroelectricity generally and the benefits of importing hydropower to meet demand. In particular, the study notes multiple examples of hydropower providing “storage” for renewables or otherwise supporting integration of renewables to the

- The case studies emphasize the benefits of hydropower’s flexibility in supporting wind and solar power and reducing price volatility.

- The Columbia River Basin case study highlights that stable and low-cost hydropower attracts investment, particularly by energy-intensive industries.

- The case study chapter notes some negative environment impact from hydropower, such as loss of farmland and habitat, but generally notes the GHG emissions benefits.