In its recently issued Pumped Storage Hydropower Valuation Guidebook, the U.S. Department of Energy (DOE) provides a manual of sorts to assess the full value of specific pumped storage hydro projects.

WHY IT MATTERS

The guidebook is an extensive resource for anyone looking to seriously consider adding pumped storage to the electric power system (either by upgrading an existing unit or building a new project).

It also reveals two big challenges:

- Many of pumped storage hydro’s benefits are hard to calculate

- These benefits (in many cases) are not yet fully monetized in wholesale electricity markets

Solving these two challenges will go a long way toward bolstering the case for new long-duration pumped storage.

THE DEEP DIVE

There’s a lot to unpack in the valuation guidebook … it is, after all, over 300 pages long. DOE says the manual can be used by developers, operators of existing plants, regulators, and financial lending institutions.

In developing the guidebook, DOE’s main objective was to provide a “comprehensive and transparent valuation guidance that will support consistent valuation assessments and comparisons of pumped storage hydro (PSH) projects or project design alternatives.”

This guidance takes the form of a 15-step guideline for assessing the benefits of a particular PSH project including its value over other alternatives (i.e., natural gas peakers or 4-hour chemical batteries).

The guidebook is so thorough that it can provide guidance for almost any type of project, whether that project is large or small (from small 10 MW plants to those over 1 GW) or is located in a vertically integrated or competitive market area. Additionally, the guidebook provides guidance for how to assess benefits over various temporal scales (from short durations to longer term scales within integrated resource planning to the full lifetime of the asset).

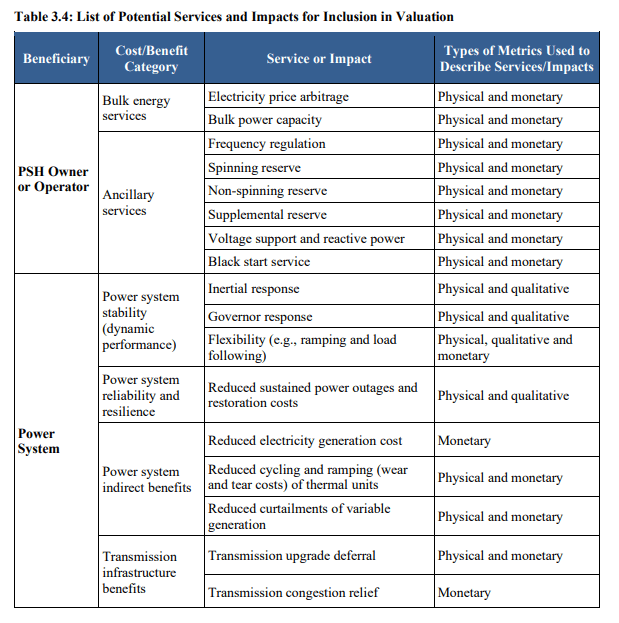

Table 3.4 from the guidebook – shown below — attempts to provide a comprehensive list of potential services a PSH unit can provide to the grid. Obviously, not all projects can provide all these services, all the time. Depending on the technology (singe speed versus variable speed turbines) and the operation of the project, many of these services can be provided in tandem, although some may not.

Essentially, the guidebook provides advice on how to co-optimize the asset within the models to ensure that benefits are not double counted. Still, the amount of products and services a single PSH unit can provide — gleaned from Table 3.4 — is impressive.

WHY VALUATION IS ‘NO EASY TASK’

One problem is that current market and regulatory structures do not provide an easy avenue to monetize all these value streams. One good example is PSH’s contribution to overall power system stability and reliability. Because PSH units tend to be large assets capable of providing substantial amounts of services within their local area, the electric power system, as a whole, benefits from the inherent flexibility of a large dispatchable asset that can provide both load and generation flexibility.

For instance, the guidebook mentions indirect benefits like cycling and ramping of PSH to avoid wear and tear from thermal units. This type of indirect value is difficult to assess (although it can be done within an integrated resource planning processes).

During the August 2020 blackouts in California, grid operators with the California ISO (CAISO) requested that certain PSH plants generate during the midday lull in energy demand. That way, CAISO didn’t have to re-start natural gas plants that can have re-start issues during high ambient conditions. This load flexibility, provided by pumped storage, enabled these thermal plants to continue reducing generator outages and prevented larger reliability issues.

But, how do you value such flexibility? Currently, wholesale markets do not value services like these. Instead, in some cases, grid operators request that PSH units operate out of merit to make sure reliability or flexibility on the system is maintained.

Beyond indirect system benefits, wholesale markets fail to place dollar values on several services that are needed to maintain reliability. Flexible ramping, synchronous inertia, governor responses and voltage support are not consistently compensated for in regional markets.

Additionally, how markets determine a resource’s contribution to capacity (or resource adequacy) varies from market to market and, in some cases, places the same value on more limited resources compared to PSH. For instance, a 2-hour short duration battery is provided an equivalent capacity accreditation to that of an 8-hour pumped storage unit.

NEXT STEPS?

The DOE guidebook is a wonderful resource that will lead to a better accounting of pumped storage hydro’s value to the operation of a reliable and resilient transmission grid.

The next step for the industry is to work with regional market operators and the Federal Energy Regulatory Commission (FERC) to ensure that these values are correctly compensated for in a technology neutral way.

The National Hydropower Association (NHA) is taking the lead in providing forums to have meaningful conversation and dialogue about these issues. At the upcoming virtual Waterpower Week, NHA is bringing leaders from regional transmission organizations (RTOs) and independent system operators (ISOs), as well as regulators, together to share their perspectives and answer questions.

Leaders include:

- Federal Energy Regulatory Commission (FERC) Commissioner Allison Clements

- California Independent System Operator Corporation – CAISO’s Interim Vice President, Market Policy & Performance Anna McKenna

- ISO New England’s Director of External Affairs Eric Johnson

- Midcontinent Independent Systems Operator (MISO)’s Executive Director, Federal Regulatory Affairs Derek Bandera

- PJM Interconnection, L.L.C.’s Vice President – Federal Government Policy Craig Glazer

In addition, specific facilitator-led discussions have been organized to bring forward the challenges and have meaningful discussion toward finding solutions. These include:

- Electricity Markets Matters: Industry Priorities and Actions, led by New York Power Authority’s Lead Energy Market Advisor Alan Michaels

- Giving Credit Where Credit Is Due: Progress in Valuing Hydro’s Contribution to Electric Power Delivery, led by Lead of the U.S. Department of Energy’s HydroWIRES Initiative Samuel Bockenhauer

- Markets in Transition, led by Yours Truly (NHA’s Vice President of Market Strategies Cameron Schilling)

Visit the event website for registration information, including rates and participation benefits.