A few weeks into starting my position with the National Hydropower Association (NHA), I met with someone who does wholesale electricity market policy for the nuclear industry. I wasn’t sure we would have many issues in common, but I was eager to hear about the industry’s recent efforts to influence market design. After exchanging our backgrounds, my new acquaintance made an interesting observation: “I think our two industries are in the same boat. We are both trying to transition from licensing to markets.”

Licensing either a nuclear facility or a hydro project is complex, lengthy and expensive undertakings. It’s true that hydropower licensing reform has been and remains an important priority for the hydropower industry. Yet, the clean energy transition, and hydro’s role in it, provide an incredible opportunity for the hydro industry to inform discussions around wholesale electricity market design.

NHA has released a new report, “Leveraging Flexible Hydro in Wholesale Markets: Principles for Maximizing Hydro’s Value,” identifying four principles to ensure that existing and new flexible resources, including hydro, are incented to provide essential reliability services that will be in greater demand to integrate variable resources.

WHY MARKET DESIGN MATTERS

How wholesale electricity markets procure energy as well as reliability services and ensure resource adequacy are all changing. And competitive markets are growing, not receding. Just look at the patchwork in the West with utilities choosing to join regional transmission organizations (RTOs). Or, look to the Southeast where several companies are starting an energy exchange (the Southeast Energy Exchange Market), or consider the growing membership in the Western Energy Imbalance Market (EIM).

As the grid evolves from a mostly thermal, dispatchable system to one where just–in–time resources like wind and solar are the predominant “fuel”, using market mechanisms to ensure reliability will be even more challenging. It reminds me of a quote I heard at a conference once: “In the grid of the future, energy will be cheap; it’s reliability that will be expensive.”

HOW HYDRO ENSURES GRID RELIABILITY

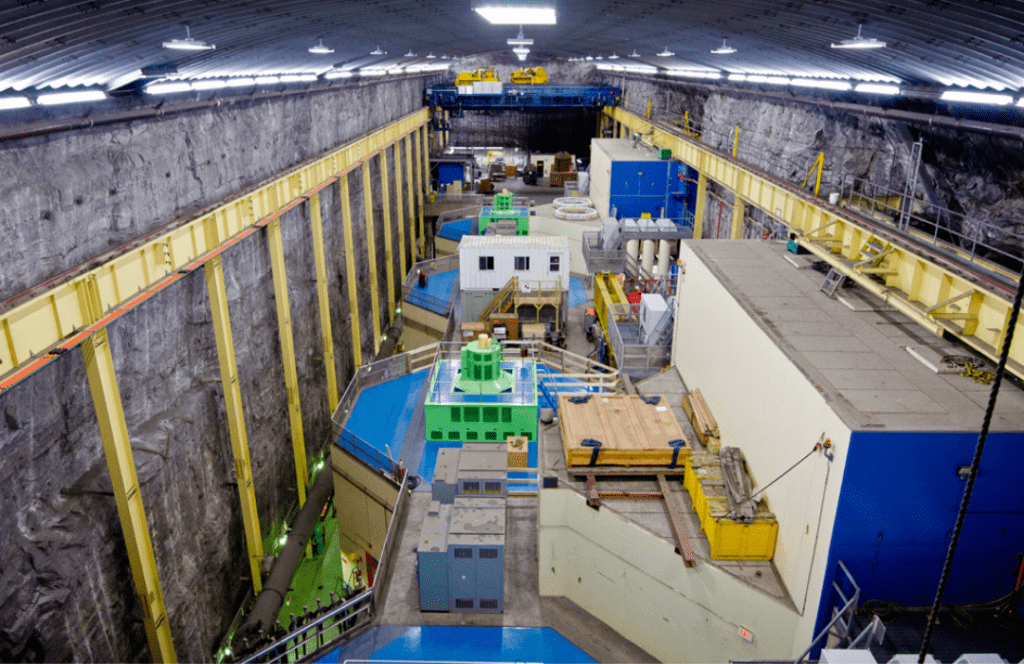

Hydropower provides the most reliability services of any resource type and it does so on a non-emitting basis. Hydro and pumped storage provide a substantial amount of ancillary services in almost every region.

For example, regulation and operating reserves are vital sources of flexibility to maintain grid reliability. In California, in the market run by the California Independent System Operation Corporation CAISO, hydropower makes up 15% of installed capacity yet provides 60% of spinning reserves and 25% of regulation reserves.

For the market run by the PJM Interconnection, the RTO that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia, hydro represents a modest share of the generation mix (<5%), but in recent years has provided 15-20% of regulation reserves and up to 40% of non-synchronized primary reserves.

In New England, the two pumped-storage hydropower resources can cover the largest contingency on the system.

IS THIS RELIABILITY VALUED IN CURRENT MARKET DESIGN?

Appreciating the importance of market policy, NHA commissioned the Brattle Group to examine how hydro participates in wholesale markets and ways that markets can better value flexible resources like hydro.

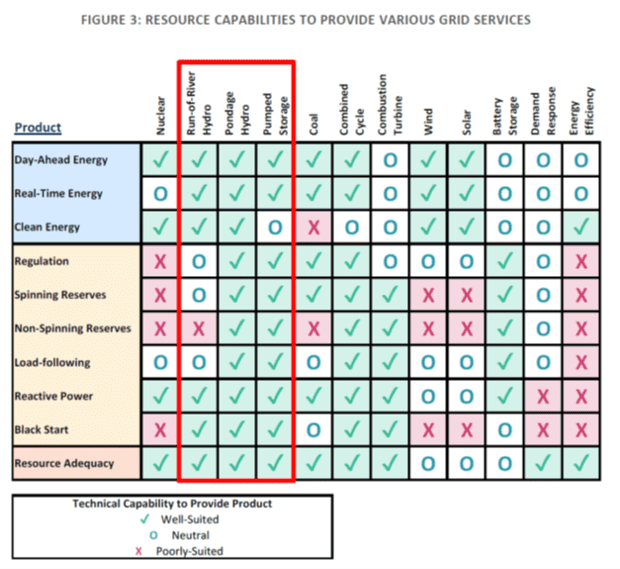

The report coming out of the examination by Brattle clearly shows the vast array of services that hydro and pumped storage offer, compared to other resources. (See the figure below, which is featured in the Brattle Group report.)

As importantly as identifying the services provided, the report also points out the critical need to correctly value these services in various market designs. Through the work of Brattle, NHA has identified areas where wholesale electricity markets do not fully capture the value of hydropower assets. The Brattle authors found that “to fully utilize hydropower in the clean energy transition, RTOs must work with hydro asset owners to continue to develop market rules that allow hydro to compete fairly with other resources, and incent and reward hydro’s unique characteristics” (Leveraging Flexible Hydro in Wholesale Markets at 24).

A recent survey of hydropower asset owners in wholesale markets found that some RTOs fail to represent the constraints of hydro systems in economic dispatches, an over-reliance of system operators on flexible hydro and pumped storage for out-of-market dispatches, and suboptimal resource adequacy accreditation.

The Brattle paper identified four principles to ensure that existing and new flexible resources are incented to provide essential reliability services that will be in greater demand to integrate variable resources. These principles are:

- New energy and ancillary services (E&AS) market products are needed to address flexibility challenges.

- RTOs should allow hydro a range of energy market participation offers including fair accounting of opportunity costs.

- Hydro and other flexible resources should be properly compensated for any out-of-market dispatches.

- All assets, including hydro, should be accredited fairly for the resource adequacy value they provide.

WHAT’S NEXT?

The clean energy transition poses both opportunities and challenges for hydropower and pumped storage. Essentially, hydro’s job description is changing. It not only must provide dispatchable, renewable energy but it must act as a balancing resource for wind and solar. This will necessarily change how hydro operators manage their assets. But markets need to change too. To integrate renewables reliably and cost effectively, flexibility and resilience must be valued.