Reaching President Biden’s ambitious targets for reducing greenhouse gas emissions will require an extraordinary effort. With hydroelectricity providing nearly 40 percent of the renewable energy generation in the United States, the need to maintain and update the country’s hydropower infrastructure is critical in our climate efforts.

But hydropower has traditionally faced unique obstacles in accessing many of the incentives that Congress has provided to spur renewable energy growth. Despite the significant opportunity domestically to develop additional hydropower capacity at existing dams and incorporate new technologies, federal incentives have largely neglected the industry, putting hydropower at a disadvantage.

Non-profit and tax-exempt community-owned electric utilities, in particular, face challenges in accessing Federal clean energy tax credits like the Investment Tax Credit (ITC) and Production Tax Credit (PTC). Even though these publicly owned utilities and rural electric co-ops serve more than 92 million Americans and own 18.4 percent of all hydropower generation, their public ownership structure makes it very difficult for them to take advantage of federal tax credits to build new generation infrastructure.

That severely constrains their ability to invest in cleaner energy sources and create jobs in their communities by expanding and updating hydropower infrastructure.

New proposals for direct pay could change that—with even broader implications for America’s clean energy future.

The Deep Dive: Advancing Direct Pay Options

The Partnership for Clean Energy Investment (PCEI) is the first multi-sector coalition dedicated to advancing a comprehensive direct pay policy to unlock clean energy growth. Direct pay would help fix a broken tax equity system that has held clean energy back by making credits like the ITC and PTC refundable and providing the credit as an up-front payment.

Here’s how it works, according to an article published by JD Supra:

“Direct pay eliminates the need to find an investor able to utilize tax credits because direct pay is not tied to tax liability. Under the new direct pay proposals, a developer would treat tax credits generated by a renewable energy project, such as the investment tax credit (ITC) or production tax credit (PTC), as equivalent to a payment of tax on the developer’s filed tax return. As a result, the developer would be entitled to receive a tax refund in the amount by which the available direct pay credit exceeds such developer’s tax liability.”

This would allow entities with little or no tax liability — like public power project owners, co-ops, or local communities — to utilize the full value of the tax credit. Direct pay could be a game changer for building long overdue hydro projects—including crucial storage and next generation technologies like pumped storage and hydrokinetic power.

Currently, many of America’s largest owners of hydropower can only benefit indirectly from federal tax incentives through long-term power purchase agreements (PPAs) with taxable project developers and tax equity financiers. That means much of the value of the credits ultimately flows to the project developers and their investors — rather than to public utilities and their customers.

A direct pay policy wouldn’t eliminate the option to use tax equity financing for companies and public power providers. But it would ensure that all clean energy providers serving Americans have equal access to crucial federal clean energy incentives at relatively low cost to taxpayers.

Policymakers on both sides of the aisle agree that a better system is needed to deliver the level of new investment that we need to meet climate goals and cement American leadership in clean energy.

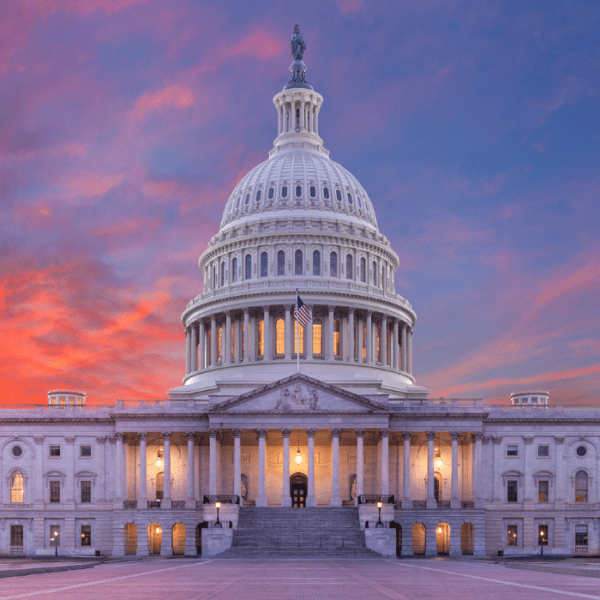

What’s Next?

Senators Maria Cantwell (D-WA) and Lisa Murkowski (R-AK)’s widely lauded Maintaining and Enhancing Hydroelectric and River Restoration Act specifically included a direct pay option for its proposed 30 percent federal investment tax credit. A group of legislators led by Senators Tom Carper (D-DE) and Ron Wyden (D-OR) and Rep. Earl Blumenauer (D-OR) have introduced their own efforts to push a direct pay policy that would help a broader swath of renewable energy sources, including hydropower.

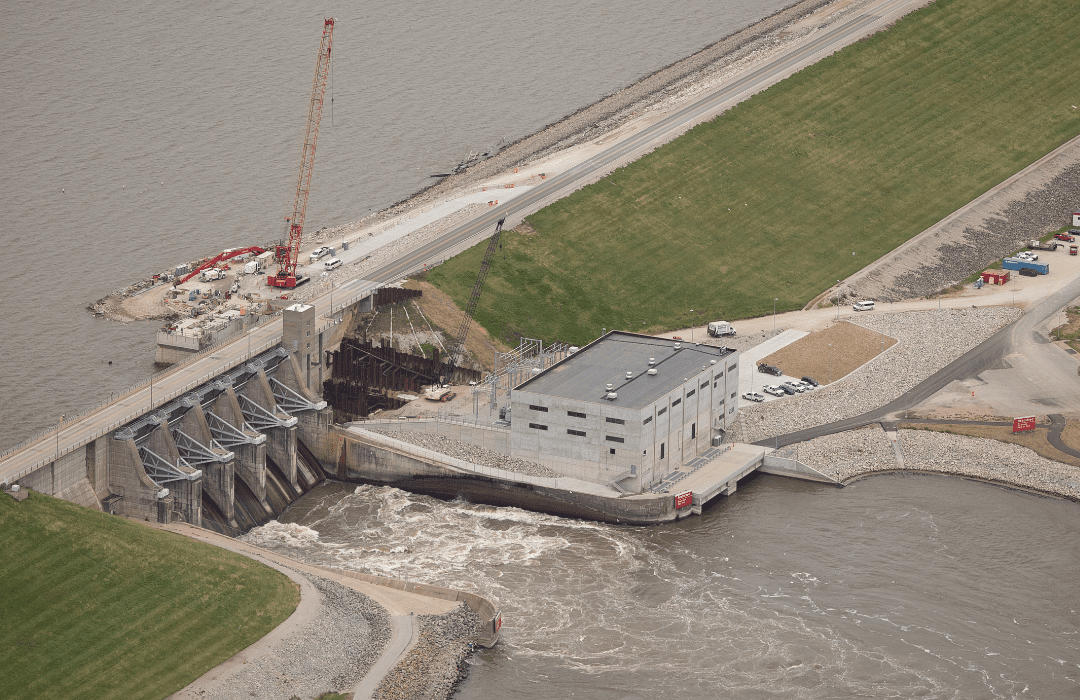

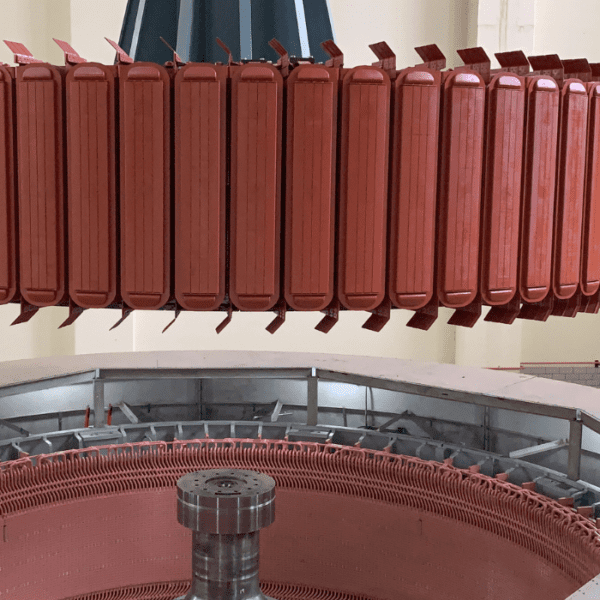

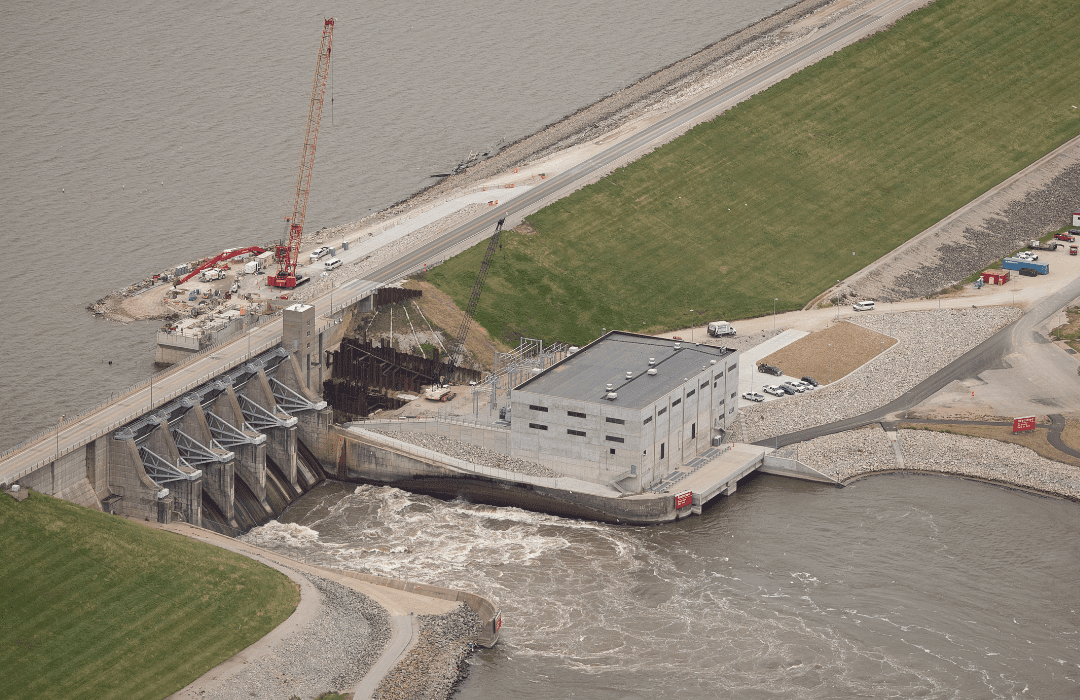

There is a pressing need to rehabilitate, retrofit, or remove more than 90,000 dams in the United States. (Only about 3% of those dams have a hydroelectric power generating component.) Smarter pro-investment polices like this could spur much-needed investments in dam safety, environmental improvements, and energy storage. Investments could include adding additional or more efficient turbines, managing sediments, refurbishing floodgates and spillways, and improving fish passage infrastructure at existing dams.

The opportunity is massive. Analysts at the Oak Ridge National Laboratory found that 12,000 megawatts (MW) of new, emissions-free hydropower could be generated at existing dams throughout the country. Pumped storage alone already contributed 93 percent of all grid storage in the United States in 2019 and there are plenty of opportunities for additional development.

Making sure projects like that have access to the best financing possible would go a long way toward meeting President Biden’s net-zero goals.

With the debate over the Senate’s infrastructure package raging and the promise of a more controversial reconciliation package later this year, direct pay should be one thing both sides can agree on: a simple, cost effective way to unlock billions of dollars of clean energy investment our country needs.

The Partnership for Clean Energy Investment is a joint initiative of renewable energy developers, financiers, utilities, corporate power purchasers, and others committed to advocating for urgent action to unleash capital for renewable investment to meet the challenges of climate change, accomplish clean energy goals, and drive economic prosperity. To learn more about the Partnership and its members, visit www.PartnershipforCleanEnergyInvestment.com or follow us on Twitter and LinkedIn.