As the Federal Energy Regulatory Commission (FERC) eyes reform to energy and ancillary service markets, what might that mean for conventional hydropower and pumped storage?

FERC’s Richard Glick has been a tireless advocate for wind and solar since being named Chairman a year ago. He’s begun a significant rulemaking to reform transmission development … a move that will bolster prospects for wind and solar whose greatest potential lies in areas of the United States far from where electricity is consumed.

Glick has all but ordered every regional transmission organization (RTO) with a capacity market to get rid of a Trump-era rule that prevented new, subsidized resources (almost exclusively wind and solar) from bidding below their true costs and thereby suppressing prices.

And he’s prioritized implementation of Order 2222, a new rule to integrate distributed generation (again, mostly wind, solar and batteries) into the wholesale market.

But, in the wake of recent blackouts in California and Texas, Glick has changed his tune somewhat and begun to focus on reforming energy and ancillary service markets. The reason behind the effort? Well, Glick’s opening remarks at a 2021 technical conference on this subject shed some light:

“We are becoming increasingly reliant on intermittent generation resources, renewables, primarily wind and solar, and they offer a lot of benefits. They reduce costs for consumers, and they also help obviously address climate change, which is the most important issue I think this country is facing from an environmental perspective today. But they also present some challenges, intermittent resources you know, as I always said the wind doesn’t always blow, and the sun doesn’t always shine. And so there’s a need for flexibility and flexible resources, and that’s what we’re here in large part to talk about today.”

WHY IT MATTERS

This is a welcome change in tone from a Commission that has been more focused on getting new technologies onto the grid and less focused on leveraging the existing flexible clean energy we already have.

So, what will this all mean for hydropower and pumped storage?

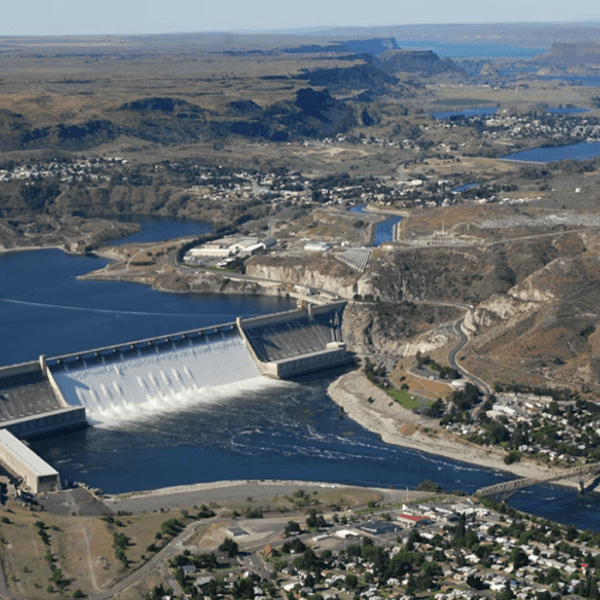

The more wholesale electricity markets begin to value the non-energy services the grid needs the better. Today, many of these services are undercompensated or not compensated at all (a fact pointed out by Brattle in the 2021 report “Leveraging Flexible Hydropower in Wholesale Markets”).

THE DEEP DIVE

Here’s a couple new and emerging products related to energy and ancillary services and what they could mean for hydropower.

Ramping or Load Following

Three RTOs (CAISO, MISO and SPP). have approved products for “ramping.” Although the definitions differ, the basic idea is to reward certain resources that can adjust their output over a given time frame to meet the system’s ramping needs.

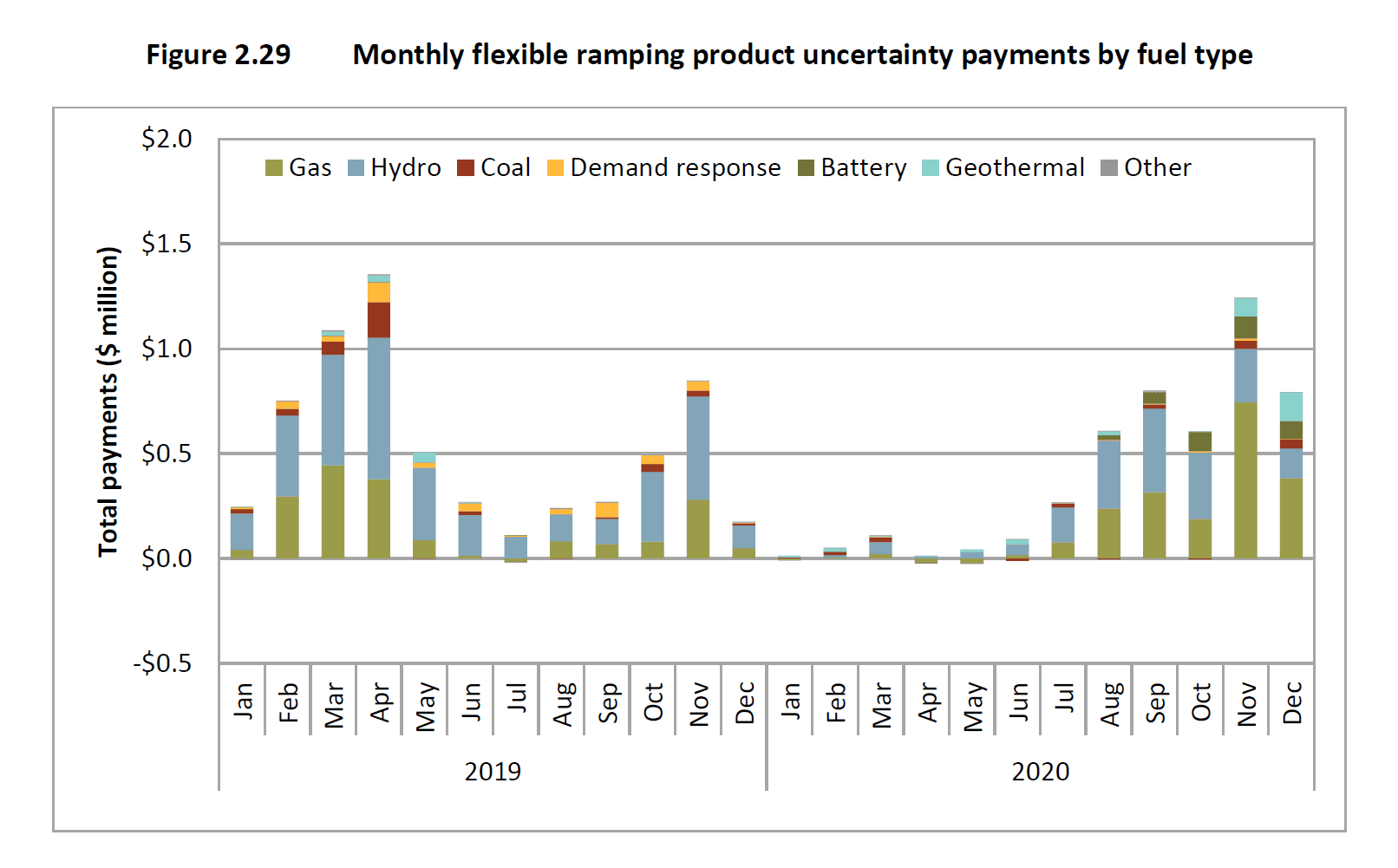

CAISO has both a resource adequacy ramping product and a real-time 15- and 5-minute product to reward flexible generators. The good news is that hydropower appears to be a large recipient of ramping awards — receiving over 39% of total revenue.

The figure below demonstrates that hydropower is receiving more revenue, on average, than even natural gas (despite hydro being a much smaller percentage of capacity). However, to date, the total revenue from these products has been lackluster. In 2021, the flexible ramping product produced only $3.6 million for all generators.

ORDC (Operating Reserve Demand Curve)

Operating reserves are the generating capacity available on standby to meet NERC-mandated reserve requirements. Typically, this requirement is the largest failure that could occur on the system … like a large generator tripping offline or a transmission line going out of service.

The demand curve is administratively determined around this 1st and 2nd contingency requirement, meaning that any operating reserves above this amount have $0 value and are priced as such.

However, RTOs/ISOs do not typically purchase sufficient reserves within-market to be able to respond to numerous real-time operational uncertainties, including load-forecasting errors, resource availability and performance, and the variability of wind and solar.

To obtain sufficient reserves, operators have taken actions to either bias demand in the software or to procure additional reserves; however, those costs are not reflected in market prices.

The ORDC seeks to price these actions into the market, thereby letting the scarcity or surplus of operating reserves drive the price rather than the administratively determined demand curve.

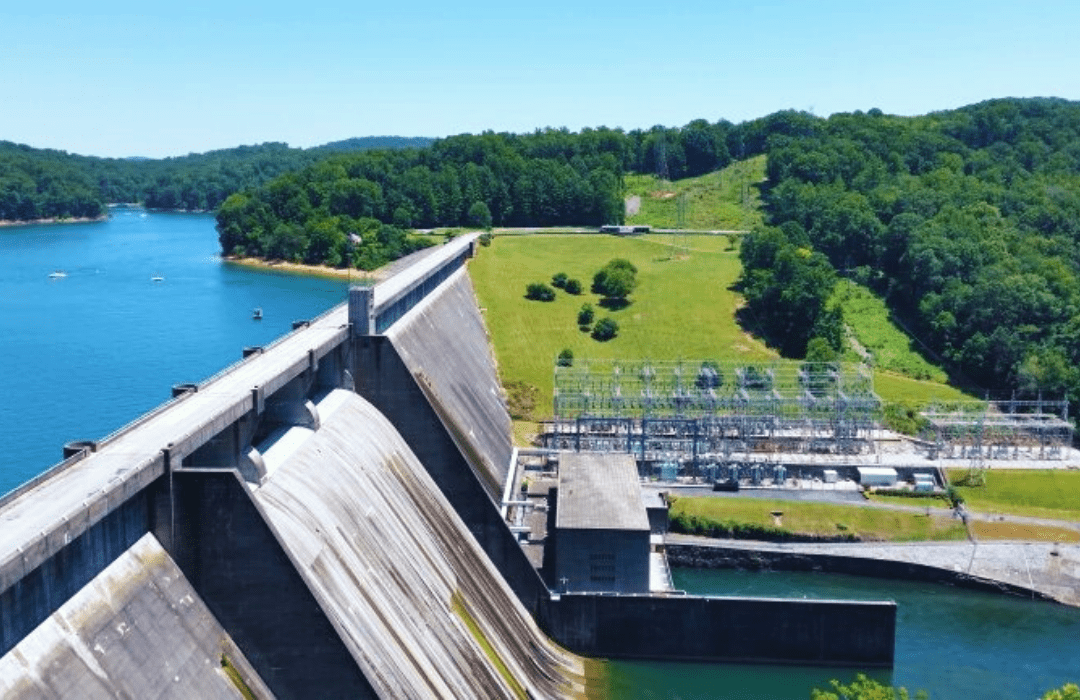

Hydropower and pumped storage are a large source of operating reserves throughout the U.S. For example, in California, hydro is only 14% of installed capacity in CAISO but can provide up to 60% of spinning reserves.

The better pricing of reserves in scarcity conditions the more value there will be to resources who provide operating reserves like hydropower.

WHAT’S NEXT?

Let’s hope that Glick and the other FERC Commissioners keep focusing on polices that will enable a reliable and cost-effective energy transition.

We already have clean, flexible generation on the grid today in the form of hydropower and pumped storage. We need to leverage it and ensure it is being compensated fairly for the value it provides.

To this end, the National Hydropower Association (NHA) recently submitted comments to FERC on ways that energy and ancillary service markets can be reformed to better value all flexible resources.

During the upcoming Waterpower Week in Washington event, owned and organized by NHA, Chairman Glick will speak on Wednesday morning, April 6, and undoubtedly will have something to say about electricity market reforms. The conference also features two sessions focused on wholesale electricity markets activities and priorities throughout the U.S. and how hydro is being affected.

‘Early bird’ registration for attending Waterpower Week is available until February 18.