Hydropower is coming back.

That, more or less, is the takeaway from the results of a massive two-and-a-half-year study released by the Department of Energy Tuesday. Hydropower Vision asserts that there is a viable pathway to drastically expand “America’s first renewable electricity source,” breaking the period of static hydropower growth that has persisted for the last two decades.

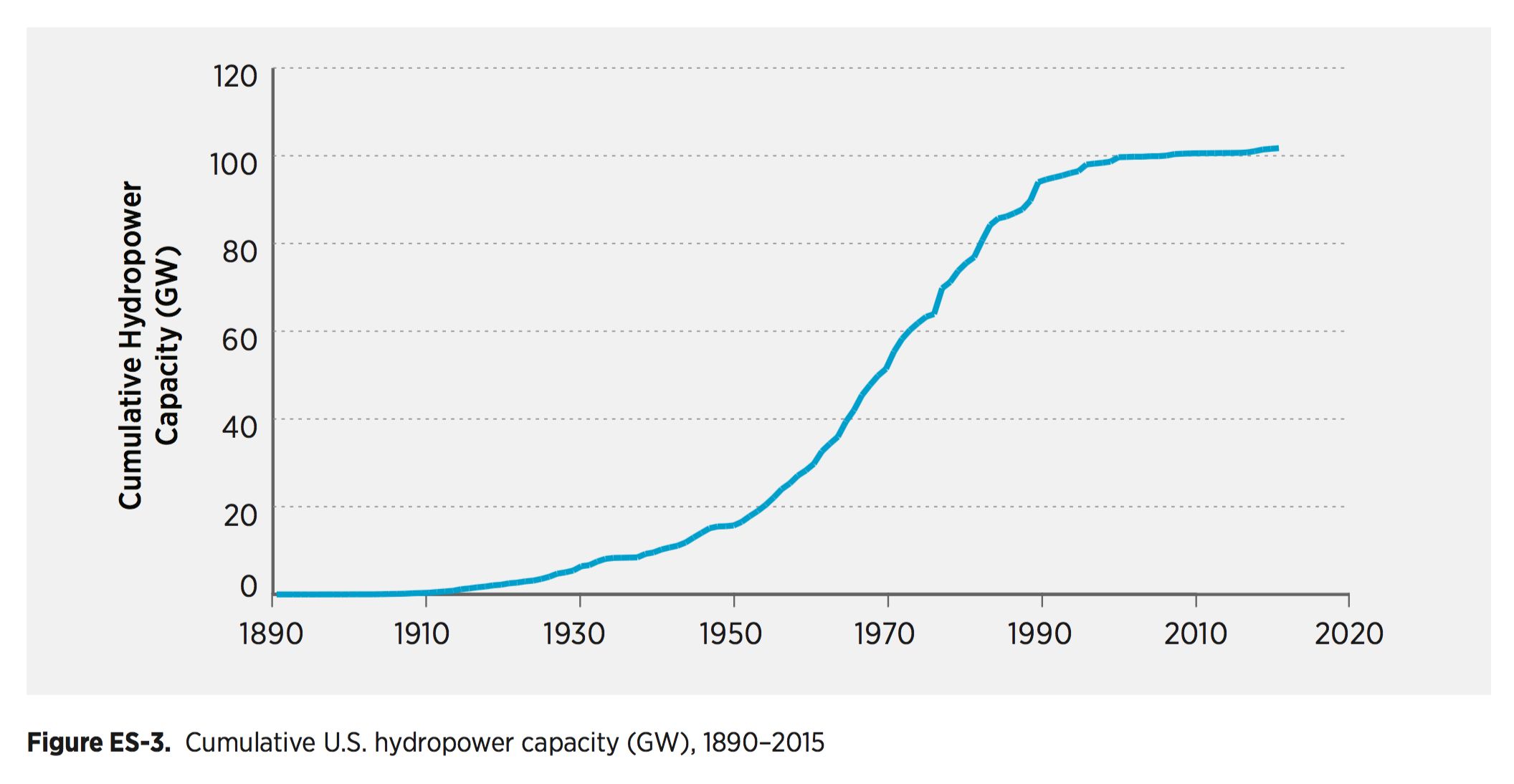

In the scenario that combines continued growth of new technologies, access to lower-cost financing, and commitments to the environmental health of rivers, it will be possible to expand U.S. hydropower from the current 101 gigawatts of generation and storage capacity to almost 150 gigawatts by 2050, according to the study. Most of that -- 36 gigawatts -- would be new pumped storage, joined by 13 gigawatts of new generating capacity.

At this point in the nation’s development, most any attractive dam opportunity has already been built. As such, only 1.7 gigawatts would come from new stream-reach development. Even that will be difficult: “Future development of projects at previously undeveloped sites and waterways is likely to remain limited without innovative -- even transformational -- advances in technologies and project development methods to meet sustainability objectives,” the report states.

The rest of the new generation would come from upgrades to generating dams and by adding generation to non-powered dams. Only 3 percent of the existing 87,000 dams in the U.S. actually have the ability to produce electricity; the vast majority just hold back water.

The Department of Energy also announced $9.8 million in funding to develop low-head modular technologies to work at existing dams, as well as closed-loop pumped-hydro storage systems.

The Hydropower Vision project gives off the sense of an industry that feels underappreciated for all the hard work it’s done. While investors and the media have heaped their praise and attention on renewables in recent years, they really just meant wind and solar. That neglects hydro’s role as the godfather of American clean energy, supplying 85 percent of the cumulative renewable energy produced over the last 65 years.

Hydropower blossomed through the second half of the 20th century, but growth plateaued in the beginning of the 21st. (DOE)

Even today, hydro generates 6 percent of U.S. electricity production, more than wind and solar combined (that’s according to Energy Information Agency numbers based on utility-scale production). Pumped water storage absolutely dominates the utility-scale electricity storage sector, with 97 percent of capacity. That should earn some back-pats all around.

Several factors, though, have kept hydro below the radar of the energy transformation currently taking place. The aforementioned difficulty in siting new facilities won’t go away, for good reason -- a lot of damage was done by blocking off rivers and flooding valleys before we understood the full ecological ramifications of these actions. That sensitivity has led to a lengthy and laborious licensing process, which the hydro industry hopes can be streamlined.

The report identifies another area for reform that will be familiar to anyone following the battles over valuing storage and other distributed energy resources: market design.

“The full valuation, optimization, and compensation for hydropower generation and ancillary services in power markets is difficult, and not all benefits and services provided by hydropower facilities are readily quantifiable or financially compensated in today’s market framework,” the report says.

Unlike wind and solar, hydro can provide highly reliable baseload energy. At the same time, it can operate with greater flexibility than the other forms of baseload generation, enabling rapid response to fluctuations in grid supply and demand. That’s becoming all the more crucial to the grid as the share of variable renewable production rises. And, of course, this is done without burning fossil fuels.

“Improvement in the way markets value grid reliability services, air quality and reduced GHG emissions, and long asset lifetimes can increase revenues,” the analysis notes.

In short, the proposed hydropower renaissance is far from certain. It requires a major policy overhaul of energy markets, which will be a long time coming. It would benefit greatly from carbon pricing, if that ever happens in the U.S. And it will need technological breakthroughs to achieve the remaining hydro generation potential without running afoul of the environment.

Hydro has a daunting and turbulent growth trajectory ahead -- but that's better than no growth at all.